8-K: Current report filing

Published on February 18, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported):

(Exact Name of Registrant as Specified in Charter)

|

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

||

| (Address of Principal Executive Offices) | (Zip Code) |

(

(Registrant’s telephone number, including area code)

Unite Acquisition 1 Corp.

12 E. 49th Street, 11th Floor, New York, NY 10017

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

EXPLANATORY NOTE

As used in this Current Report on Form 8-K (this “Report”), unless otherwise stated or the context clearly indicates otherwise, the terms the “Company,” “we,” “us” and “our” refer to Adaptin Bio, Inc., incorporated in the State of Delaware, and its subsidiaries after giving effect to the Merger (as defined below) and the company name change described herein.

The registrant was incorporated as Unite Acquisition 1 Corp. (“Unite Acquisition”) in the State of Delaware on March 10, 2022. Prior to the Merger (as defined below), the registrant was a “shell company” (as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)).

On February 11, 2025, Unite Acquisition’s wholly-owned subsidiary, Adaptin Acquisition Co., a Delaware corporation formed in the State of Delaware on January 30, 2025 (“Merger Sub”), merged with and into Adaptin Bio, Inc., a privately held Delaware corporation (“Private Adaptin”) formerly known as Centaur Bio Inc. Pursuant to this transaction (the “Merger”), Private Adaptin was the surviving corporation and became the Company’s wholly owned subsidiary, and all of the outstanding stock of Private Adaptin was converted into shares of the combined Company’s common stock, par value $0.0001 per share (the “Common Stock”). In addition, in connection with the Merger, all of Private Adaptin’s outstanding convertible promissory notes converted into shares of Common Stock at $3.30 per share and all of Private Adaptin’s outstanding warrants became exercisable for shares of Common Stock.

As a result of the Merger, we acquired the business of Private Adaptin and will continue its business operations as a public reporting company under the same name, Adaptin Bio, Inc. Concurrent with the consummation of the Merger, Private Adaptin changed its name to “Adaptin Bio Operating Corporation.”

Concurrent with the closing of the Merger, the Company also sold 1,080,814 units (the “Units”) at a purchase price of $4.40 per Unit, each consisting of (i) one share of Common Stock, (ii) a one-year warrant to purchase one share of Common Stock at an exercise price of $4.40 per share, and (iii) a five-year warrant to purchase one-half of a share of Common Stock at an exercise price of $6.60 per share. Additional information concerning the private placement is presented below under Item 2.01, “Completion of Acquisition or Disposition of Assets—The Merger and Related Transactions—The Offering” and under Item 3.02, “Unregistered Sales of Equity Securities.” This Report is not a solicitation for or an offer to purchase Units.

In accordance with “reverse merger” or “reverse acquisition” accounting treatment, our historical financial statements as of period ends, and for periods ended, prior to the Merger will be replaced with the historical financial statements of Private Adaptin prior to the Merger, in all future filings with the U.S. Securities and Exchange Commission (the “SEC”).

This Report contains summaries of the material terms of various agreements executed in connection with the transactions described herein. The summaries of these agreements are subject to, and are qualified in their entirety by, reference to these agreements, which are filed as exhibits hereto and incorporated herein by reference.

This Report responds to the following Items:

| Item 1.01 | Entry into a Material Definitive Agreement. |

| Item 2.01 | Completion of Acquisition or Disposition of Assets. |

| Item 3.02 | Unregistered Sales of Equity Securities. |

| Item 3.03 | Material Modification to Rights of Security Holders. |

| Item 4.01 | Changes in Registrant’s Certifying Accountant. |

| Item 5.01 | Changes in Control of Registrant. |

| Item 5.02 | Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers. |

| Item 5.03 | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

| Item 5.05 | Amendments to the Registrant’s Code of Ethics, or Waiver of a Provision of the Code of Ethics. |

| Item 5.06 | Change in Shell Company Status. |

| Item 9.01 | Financial Statements and Exhibits. |

Prior to the Merger, we were a “shell company” (as such term is defined in Rule 12b-2 under the Exchange Act). As a result of the Merger, we have ceased to be a “shell company.” The information included in this Report constitutes the current “Form 10 information” necessary to satisfy the conditions contained in Rule 144(i)(2) under the Securities Act of 1933, as amended (the “Securities Act”).

FORWARD-LOOKING STATEMENTS

This Report, including the sections entitled “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Description of Business”, includes forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward-looking statements relate to, among others, our plans, objectives and expectations for our business, operations and financial performance and condition, and can be identified by terminology such as “may,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “will,” “could,” “project,” “target,” “potential,” “continue” and similar expressions that do not relate solely to historical matters. Forward-looking statements are based on management’s belief and assumptions and on information currently available to management. Although we believe that the expectations reflected in forward-looking statements are reasonable, such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by forward-looking statements.

Forward-looking statements include, but are not limited to, statements about:

| ● | our ability to raise additional money to fund our operations for at least the next twelve months as a going concern; |

| ● | our ability to develop our current and any future product candidates; |

| ● | our ability to receive marketing approval from the FDA for our product candidates; |

| ● | our ability to maintain our license rights to our intellectual property and to adequately protect or enforce our intellectual property rights; |

| ● | our reliance on third parties to supply drug substance and drug product for our clinical trials and preclinical studies, and produce commercial supplies of product candidates; |

| ● | our ability to market and commercialize our products, if approved; |

| ● | our product candidates’ ability to achieve market acceptance, if approved; |

| ● | developments and projections relating to our competitors and our industry; |

| ● | our ability to adequately control the costs associated with our operations; |

| ● | our dependence on third-party reimbursement for commercial viability; |

| ● | the impact of current and future laws and regulations, especially those related to drug development and drug pricing controls; |

| ● | potential cybersecurity risks to our operational systems, infrastructure, and integrated software by us or third-party vendors; |

| ● | the development of a market for our Common Stock; and |

| ● | other risks and uncertainties, including those listed under the caption “Risk Factors.” |

We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, operating results, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, including those described in the section titled “Risk Factors.” Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, the future events and trends discussed in this Report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

1

You should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, performance, or achievements. We undertake no obligation to update any of these forward-looking statements for any reason after the date of this Report or to conform these statements to actual results or revised expectations, except as required by law.

You should read this Report and the documents that we reference in this Report as exhibits with the understanding that our actual future results, performance, and events and circumstances may be materially different from what we expect.

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

The information contained in Item 2.01 below relating to the various agreements described therein is incorporated herein by reference. All descriptions of the agreements described below are qualified in their entirety by reference to the form of the relevant agreement that is filed as an exhibit to this Report and incorporated herein by reference.

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS.

THE MERGER AND RELATED TRANSACTIONS

Bridge Financings

Private Adaptin raised bridge financing through the offer and sale (a) in 2023 of $500,000 principal amount of its 10% Secured Promissory Notes (the “2023 Bridge Notes”) (including warrants to purchase up to 56,815 shares of our Common Stock at an exercise price of $4.40 per share) and (b) in 2024 of $1,000,000 principal amount of its 10% Secured Subordinated Convertible Promissory Notes (the “2024 Bridge Notes”, which in each case were sold to a limited number of accredited investors pursuant to Regulation D under the Securities Act. The 2023 Bridge Notes were exchanged for $500,000 principal amount of the Company’s 10% Secured Convertible Promissory Notes (the “Exchange Notes”). In connection with the note exchange, the holders of the 2023 Bridge Notes were also issued warrants to purchase up to 75,755 shares of our Common Stock at an exercise price of $3.30 per share. The Exchange Notes and the 2024 Bridge Notes are referred to herein as the “Bridge Notes.”

At the closing of the Offering (as defined below), the $1,500,000 aggregate principal amount of outstanding Bridge Notes, plus accrued interest thereon, automatically converted into shares of Company common stock, par value $0.0001 per share (“Common Stock”), at a conversion price of $3.30 per share, or 501,140 shares of Company Common Stock (the “Note Conversion Shares”), and the holders of the 2023 Bridge Notes were issued, pursuant to existing agreements, warrants to purchase up to 132,570 shares of our Common Stock at an exercise price of either $3.30 or $4.40 per share and with a term of five years, as described above (the “Pre-Merger Warrants”).

Merger Agreement

On February 11, 2025, we entered into the Merger Agreement with Merger-Sub and Private Adaptin, pursuant to which Merger Sub merged with and into Private Adaptin, with Private Adaptin continuing as the surviving corporation and as our wholly owned subsidiary.

Pursuant to the Merger Agreement, all of the outstanding capital stock of Private Adaptin was cancelled in exchange for shares of Common Stock, and all of the outstanding Private Adaptin warrants were assumed by, the Company at the, with appropriate adjustments to the per share exercise or conversion price thereof, and otherwise on their original terms and conditions. The total number of shares of Common Stock issued to pre-Merger stockholders of Private Adaptin was 3,249,999 shares.

2

Prior to the closing of the Offering (as defined below), Unite Acquisition’s board of directors adopted an equity incentive plan reserving a number of shares of Common Stock equal to 15% of the shares to be outstanding upon each closing of the Offering, up to a maximum aggregate amount of 15% of the fully diluted shares outstanding of the Company following the final closing of the Offering (assuming exercise or conversion of all then-outstanding Common Stock equivalents), for the future issuance, at the discretion of the board of directors, of options and other incentive awards to officers, key employees, consultants and directors of the Company and its subsidiaries. See “Compensation of Directors and Executive Officers—Description of the 2025 Equity Incentive Plan” below for more information about the equity incentive plan.

The sole holder of common stock of Unite Acquisition prior to the Merger, Lucius Partners, retained 3,250,000 shares of Common Stock after the Merger.

The Merger Agreement contained customary representations and warranties and pre- and post-closing covenants of each party and customary closing conditions.

As a condition to the Merger, we entered into a pre-Merger indemnity agreement with Unite Acquisition’s sole officer and director, Nathan P. Pereira, pursuant to which the Company agreed to indemnify Mr. Pereira for actions taken by him in his official capacity relating to the consideration, approval and consummation of the Merger and certain related transactions.

We expect the Merger to be treated as a recapitalization and reverse acquisition for us for financial reporting purposes. Private Adaptin is to be considered the acquirer for accounting purposes, and our historical financial statements before the Merger will be replaced with the historical financial statements of Private Adaptin before the Merger in future filings with the SEC. The Merger is intended to be treated as a tax-free reorganization under Section 368(a) of the Internal Revenue Code of 1986, as amended.

The Offering

Immediately following the effective time of the Merger, we sold in a closing of our private placement offering (the “Offering”), 1,080,814 Units, for an aggregate purchase price of $4,755,581.60, at a purchase price of $4.40 per Unit, with each Unit consisting of (i) one share of Common Stock, (ii) a warrant representing the right to purchase one share of Common Stock, exercisable from issuance until one year after the final closing of the Offering at an exercise price of $4.40 per share (the “A Warrant”), and (iii) a warrant, representing the right to purchase one-half of a share of Common Stock, exercisable from issuance until five years after the final closing of the Offering at an exercise price of $6.60 per whole share (the “B Warrant,” and together with the A Warrant, the “Warrants”) (such shares of Common Stock issuable upon the exercise of the Warrants, the “Warrant Shares”). The Company and Laidlaw & Company (UK) Ltd. (the “Placement Agent”) may conduct additional closings of the Offering at their discretion for up to $8.5 million (the “Maximum Offering”). Each investor in any subsequent closing will be required to represent that, as of the date of entering into the subscription agreement and the date of the applicable closing, it (i) has a substantive, pre-existing relationship with us or has direct contact with us or the Placement Agent outside of the Offering, and (ii) did not independently contact us or a Placement Agent or become interested in the Offering as a result of reading or otherwise being aware of this Current Report, any press release or any other public disclosure disclosing the terms of the Offering.

3

In connection with the Offering, the Placement Agent (a) will be paid at each closing from the Offering proceeds a total cash commission of 10.0% of the aggregate gross purchase price paid by purchasers in the Offering at that closing (the “Cash Fee”), (b) will be paid at each closing from the Offering proceeds a total non-allocable expense allowance equal to 2.0% of the aggregate gross purchase price paid by purchasers in the Offering at that Closing (the “Expense Allowance”), and (c) will receive (and/or its designees will receive) warrants to purchase a total number of shares of Common Stock equal to 10.0% of the sum of (i) the number of shares of Common Stock included in the Units sold in the Offering at that closing and (ii) the number of shares of Common Stock issuable upon exercise of the Warrants included in the Units sold in the Offering at that closing, with a term expiring seven years after the final closing date and an exercise price of $4.40 per share (the “Placement Agent Warrants”). Any sub-agent of the Placement Agent that introduces investors to the Offering will be entitled to share in the Cash Fee, Expense Allowance and Placement Agent Warrants attributable to those investors pursuant to the terms of an executed sub-agent agreement with such Placement Agent. The Company has agreed to pay certain other expenses of the Placement Agent, including the fees and expenses of its counsel, in connection with the Offering. Subject to certain customary exceptions, we will also indemnify the Placement Agent to the fullest extent permitted by law against certain liabilities that may be incurred in connection with the Offering, including certain civil liabilities under the Securities Act, and, where such indemnification is not available, to contribute to the payments the Placement Agent and its sub-agents may be required to make in respect of such liabilities.

Description of Warrants

The A Warrants will have an exercise price of $4.40 per share and a term of one year from the final closing of the Offering and will be exercisable solely for cash.

The B Warrants will have an exercise price of $6.60 per share and a term of five years from the final closing of the Offering and will be exercisable either for cash or, when there is no effective registration statement covering the shares of Common Stock issuable upon exercise of the B Warrants, on a cashless net exercise basis.

The Warrants will have “weighted average” anti-dilution protection, subject to customary exceptions, including but not limited to issuances of awards under the executive incentive plan.

The Placement Agent Warrants will have an exercise price of $4.40 per share and a term of seven years from the final closing of the Offering and will be exercisable for cash or on a cashless net exercise basis.

Lock-Up Agreements

All officers and directors of the Company following the Merger and their affiliates and associated entities entered into lock-up agreements with us for a term ending two years after the closing of the Merger, whereby they have agreed to certain restrictions on the sale or disposition (including pledge) of all of our Common Stock held by (or issuable to) them. The lock-up agreements contain customary transfer exceptions.

Registration Rights

In connection with the Merger and the Offering, the Company entered into a registration rights agreement (the “Registration Rights Agreement”), pursuant to which the Company will file a registration statement (the “Registration Statement”) within 60 calendar days after termination of the Offering with the SEC registering for resale the following: (a) the shares of Common Stock issued pursuant to the subscription agreements in the Offering (the “Offering Shares”); (b) the Warrant Shares; (c) shares of Common Stock issued or issuable upon exercise of the Pre-Merger Warrants (the “Pre-Merger Warrant Shares”); (d) the Note Conversion Shares; (e) shares of Common Stock held by stockholders of the Company prior to the Merger and remaining outstanding immediately following the effective time of the Merger (the “Registrable Pre-Merger Shares”); (f) shares of Common Stock issued or issuable upon exercise of the Placement Agent Warrants (the “Placement Agent Warrant Shares”); and (g) other shares of restricted Common Stock held by the signatories to the Registration Rights Agreement acquired or issuable in respect of the foregoing shares of Common Stock by way of conversion, dividend, stock-split, distribution or exchange, merger, consolidation, recapitalization or reclassification or similar transaction (from (a) to (g), the “Registrable Shares”).

4

The 60 day period shall be tolled as of February 14, 2025, and resume when the audited financial statements of the Company for the fiscal year ending December 31, 2024 are issued, or March 31, 2025, whichever is earlier (the number of days of the 60 day period tolled as of February 14, 2025, the “Tolling Period”), and provided further that the Tolling Period, if applicable, shall be a minimum of 14 calendar days. The Company will use its commercially reasonable efforts to cause the Registration Statement to be declared effective within 120 calendar days after the termination of the Offering, plus, if applicable, a number of days equal to the Tolling Period.

If (a) the Company is late in filing the Registration Statement, (b) the Registration Statement is not declared effective within 120 days after the final closing date of the Offering (subject to certain exceptions), (c) the Registration Statement ceases for any reason to remain effective or the holders of Registrable Shares are otherwise not permitted to utilize the prospectus therein to resell the Registrable Shares for a period of more than five consecutive trading days (subject to permitted blackout periods (as defined in the Registration Rights Agreement) and certain other exceptions), or (d) following the listing or inclusion for quotation of the Common Stock on OTC Markets, Nasdaq, NYSE or NYSE American, the Registrable Shares are not listed or included for quotation on such a market, or trading of the Common Stock is suspended or halted on the principal market for the Common Stock, for more than three consecutive trading days (subject to certain exceptions) (each, a “Registration Event”), then in any such case monetary penalties payable by the Company to the holders of the Registrable Shares that are affected by such Registration Event will commence to accrue at a rate equal to 12% per annum of the total of the following, to the extent applicable to such holder: (i) if the holder is a holder of Note Conversion Shares, the product of $3.30 (as adjusted for stock splits, stock dividends, combinations, recapitalizations or similar events) multiplied by the number of Note Conversion Shares held by or issuable to such holder as of the date of such Registration Event, (ii) if the holder is a holder of Offering Shares, A Warrant Shares, Pre-Merger Warrant Shares, Registrable Pre-Merger Shares or Placement Agent Warrant Shares, the product of $4.40 (as adjusted for stock splits, stock dividends, combinations, recapitalizations or similar events) multiplied by the number of Offering Shares, A Warrant Shares, Pre-Merger Warrant Shares, Registrable Pre-Merger Shares or Placement Agent Warrant Shares, as the case may be, held by or issuable to such holder as of the date of such Registration Event, or (iii) if the holder is a holder of B Warrant Shares, the product of $6.60 (as adjusted for stock splits, stock dividends, combinations, recapitalizations or similar events) multiplied by the number of Note Conversion Shares held by or issuable to such holder as of the date of such Registration Event, but in each case, only with respect to such holder’s Registrable Shares that are affected by such Registration Event and only for the applicable Registration Default Period (as defined in the Registration Rights Agreement); provided, however, that in no event will the aggregate of any such penalties exceed 5% of the offering price per share. Notwithstanding the foregoing, no penalties will accrue with respect to any Registrable Shares removed from the Registration Statement in response to a comment from the staff of the SEC limiting the number of shares of Common Stock which may be included in the Registration Statement (a “Cutback Comment”). Any cutback resulting from a Cutback Comment (the “Reduction Securities”) shall be in the following order: (i) first from the Placement Agent Warrant Shares, on a pro rata basis among the holders thereof; (ii) second from the Registrable Pre-Merger Shares, on a pro rata basis among the holders thereof; (iii) third from the Offering Shares, the Offering Warrant Shares, the Pre-Merger Warrant Shares and the Note Conversion Shares, on a pro rata basis among the holders thereof.

The Company will use its commercially reasonable efforts to keep the Registration Statement continuously effective until the earlier of five years from the date it is declared effective by the SEC or for such shorter period ending on the earlier to occur of (a) the sale of all Registrable Shares and (b) the availability of Rule 144 for the holders to sell all of the Registrable Shares without restrictions, including volume limitations, and without the need for current public information, required by Rule 144 (other than Rule 144(i)) or otherwise, during any 90-day period.

If fewer than all of the Registrable Shares are included in the Registration Statement when it becomes effective, the Company will use its commercially reasonable efforts within 60 calendar days after the effective date of the Registration Statement, or within ten business days after the first date that is permitted by the SEC to, register for resale as many of the Reduction Securities as the SEC will permit (pro rata among the holders of such Reduction Securities) using one or more registration statements that it is then entitled to use, and to cause such registration statement(s) to become effective as soon as practicable, until all of the Reduction Securities have been so registered; provided, however, that the Company shall not be required to register such Reduction Securities during a Blackout Period (as defined in the Registration Rights Agreement).

The holders of Registrable Shares shall have “piggyback” registration rights for Registrable Shares not registered as provided above with respect to any registration statement filed by the Company following the effectiveness of the aforementioned Registration Statement that would permit the inclusion of such underlying shares, subject, in an underwritten offering, to customary cut-back on a pro rata basis among the holders of Registrable Shares if the underwriter or the Company determines that marketing factors require a limitation on the number of shares of stock or other securities to be underwritten.

5

OTC Quotation

Our Common Stock is currently not listed on a national securities exchange or any other exchange, or quoted on an over-the-counter market. Following completion of the Offering, we intend to cause our Common Stock to be quoted on the OTC Markets QB tier as soon as practicable following the effectiveness of the Registration Statement. However, we cannot assure you that we will be able to do so and, even if we do so, there can be no assurance that our Common Stock will continue to be quoted on the OTC Markets or quoted or listed on any other market or exchange, or that an active trading market for our Common Stock will develop or continue. See “Risk Factors—There is currently no market for our Common Stock and there can be no assurance that any market will ever develop.”

Our 2025 Equity Incentive Plan

Pursuant to the Merger Agreement, Unite Acquisition adopted the 2025 Equity Incentive Plan (the “2025 Plan”), which provides for the issuance of incentive awards of stock options, restricted stock awards, restricted stock units, stock appreciation rights and performance awards. The number of shares reserved for issuance under the 2025 Plan will increase automatically on January 1 of each of 2026 through 2035 by the number of shares equal to the lesser of 4% of the total number of outstanding shares of our Common Stock as December 31 (calculated on a fully-diluted and as-converted basis), or a number as may be determined by the Company’s board of directors. See “Compensation of Directors and Executive Officers—Description of the 2025 Equity Incentive Plan” below for more information about the 2025 Plan.

Departure and Appointment of Directors and Officers

Prior to the effective time of the Merger, the Unite Acquisition board of directors consisted of one member, Mr. Pereira, who also was its President, Chief Executive Officer, Chief Financial Officer, and Secretary. As of the Effective Time, Mr. Pereira resigned from the board of directors, and Patrick Gallagher, Simon Pedder, Michael J. Roberts, J. Nick Riehle and Anthony Zook were appointed to the Company’s board of directors.

Also, as of the Effective Time, Mr. Pereira resigned from all officer positions with the Company, and Simon Pedder was appointed as our Executive Chairman, Michael J. Roberts was appointed as our President and Chief Executive Officer, Timothy L. Maness was appointed as our Chief Financial Officer, and L. Arthur Hewitt was appointed as our Chief Development Officer.

See “Management” below for information about our new directors and executive officers.

Combined Company Ownership

Following the Merger and the closing of the Offering, there are issued and outstanding 8,081,953 shares of our Common Stock, as follows:

| ● | the stockholders of Private Adaptin prior to the Merger will hold 3,249,999 shares of our Common Stock; |

| ● | investors in the Offering will hold 1,080,814 shares of our Common Stock; |

| ● | former holders of the Bridge Notes will hold 501,140 shares of our Common Stock; and |

| ● | Unite Acquisition’s sole stockholder prior to the Merger will hold 3,250,000 shares of our Common Stock. |

In addition, there are outstanding:

| ● | A Warrants to purchase 1,080,814 shares of our Common Stock; |

| ● | B Warrants to purchase 540,407 shares of our Common Stock; |

| ● | Placement Agent Warrants to purchase an aggregate of 270,204 shares of our Common Stock; and |

| ● | Pre-Merger Warrants to purchase 132,570 shares of our Common Stock. (Like the B Warrants, the Pre-Merger Warrants will be exercisable either for cash or, when there is no effective registration statement covering the shares of Common Stock issuable upon exercise of the Pre-Merger Warrants, on a cashless net exercise basis.) |

6

In addition, there are up to 2,196,390 shares of our Common Stock reserved for future issuance under the 2025 Plan. No other securities convertible into or exercisable or exchangeable for our Common Stock are outstanding as of the date of this Current Report.

Accounting Treatment; Change of Control

The Merger is being accounted for as a “reverse merger” or “reverse acquisition,” and Private Adaptin is deemed to be the acquirer in the reverse merger. Consequently, the assets and liabilities and the historical operations that are reflected in our financial statements relating to periods prior to the Merger are those of Private Adaptin, and are recorded at the historical cost basis of Private Adaptin, and the consolidated financial statements after completion of the Merger will include the assets and liabilities of Private Adaptin, historical operations of Private Adaptin, and operations of the Company from the Closing Date. As a result of the issuance of the shares of our Common Stock pursuant to the Merger, a change in control of the Company occurred as of the date of consummation of the Merger.

Except as described in this Report, no arrangements or understandings exist among present or former controlling stockholders with respect to the election of members of our board of directors and, to our knowledge, no other arrangements exist that might result in a change of control of the Company.

We continue to be a “smaller reporting company,” as defined under the Exchange Act, and an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) following the Merger. We believe that as a result of the Merger, we have ceased to be a “shell company” (as such term is defined in Rule 12b-2 under the Exchange Act).

FORM 10 INFORMATION

DESCRIPTION OF BUSINESS

Formation History

The Company is a Delaware corporation initially formed in March 2022 as Unite Acquisition 1 Corp. Effective February 11, 2025, Unite Acquisition’s wholly owned subsidiary, Merger Sub, merged with an into Private Adaptin, a Delaware corporation. Private Adaptin was the surviving corporation in the transaction and became Unite Acquisition’s wholly owned subsidiary, renamed as Adaptin Operating Co. At the same time, Unite Acquisition changed its name to Adaptin Bio, Inc.

The Company’s website address is www.adaptinbio.com and we can be contacted at info@adaptinbio.com. Information contained on, or that can be accessed through, our website is not a part of this Report.

Business Overview

Adaptin is a biopharmaceutical company pioneering a transformational approach to enhance the transfer of therapeutics into the brain, facilitating the treatment of brain cancers and other unmet medical conditions. The Company’s proprietary technology harnesses the human immune system’s ability to target, recognize, destroy or deliver therapeutics to specific cells, including cancer cells. Our mission is to be the global leader and pioneer of this new treatment paradigm, integrating recombinant technology, gene therapy and cell therapy to address the challenges of targeting and delivering effective therapies, including to the brain for cancer and other central nervous system (“CNS”) indications.

The cause(s), or etiology, of many diseases can be addressed in part through manipulation of engineered cells. We view targeted manipulation of the human immune system, together with recombinant technology and/or gene therapy, as a therapeutically disruptive transformation in the way we treat brain and other diseases. Our experienced group of scientists and business leaders are developing our proprietary in vivo and ex vivo technology platforms to revolutionize treatment across a broad array of therapeutic areas with unmet treatment needs, including oncology, CNS disorders, autoimmune disease and cardiovascular diseases, among others. Our lead product candidate has been recently accepted under an investigator-led IND to begin first-in-human studies in brain cancer. Our goal is to complete preclinical studies on additional product candidates and file multiple investigational new drug applications (each, an “IND”) in 2026, if not earlier.

7

Adaptin’s novel technology was originally developed by researchers in the Department of Neurosurgery at Duke University, led by Dr. John H. Sampson, the prior Robert H. and Gloria Wilkins, Distinguished Professor and Chair of the Department of Neurosurgery and currently the Dean and Vice Chancellor at the University of Colorado School of Medicine. The group recognized that adoptive transfer of specifically activated functional human immune cells significantly increases the “hitchhiking” and intracerebral accumulation of macromolecules that are bound to their surface. While circulating naïve T cells do not typically penetrate the CNS, activated T cells are known to traffic frequently past the blood brain barrier (“BBB”) and perform routine immune surveillance in the CNS. Adaptin and its collaborators at Duke University are taking advantage of this CNS trafficking to enhance the localization of macromolecules and other agents to the CNS for cancer and other CNS disorders.

Adaptin is closely working with researchers at Duke University to translate preclinical proof of concept data of its first proprietary platform technology called BRiTE (Brain Bispecific T-cell Engager) into human clinical trials. BRiTE focuses on the transport of difficult to deliver T cell targeting agents to tumor tissue, including in the immunoprivileged brain and overcoming the challenges with other immunotherapeutic approaches. BRiTE is a translatable method to specifically target malignant glioma using a tumor-specific, fully human bispecific antibody that redirects patients’ own T cells to recognize and destroy tumor cells.

The first application of Adaptin’s technology is APTN-101, a proprietary epidermal growth factor receptor variant III, or EGFRVIII, BRiTE in order to eliminate malignant glioma tumors in a variety of aggressive preclinical tumor models where the tumor is implanted behind the BBB in the CNS (i.e., orthotopic). We designed APTN-101 to specifically redirect T cells against tumors expressing a well-characterized, mutated form of epidermal growth factor receptors (“EGFRs”) known as EGFRVIII, on a number of tumor types, including glioblastoma, breast and lung cancer. Because EGFRVIII is exclusively expressed on tumor cells, but not normal healthy cells, we believe it represents an ideal target for immunotherapy. We have made significant progress towards first-in-human clinical studies, including:

| ● | A pre-IND meeting with the U.S. Food and Drug Administration (the “FDA”) outlining a clear path to filing an IND; |

| ● | Completion of single-dose IND-enabling preclinical studies; |

| ● | Submission in April 2023 of an IND for an investigator-initiated, single-dose clinical trial, and its acceptance in May 2023 by the FDA; and |

| ● | Manufacturing of APTN-101 in more than sufficient quantities for Phase 1 trials. |

We also expect to expand our proprietary platform to other targets and indications. The Company is exploring several external opportunities to continue to advance and expand the product pipeline.

Strategy

Our goal is to become a leading biopharmaceutical company focused on the transfer of drugs across barriers and to targeted tissues, including the brain and CNS, to transform current treatment paradigms for patients and address unmet medical needs. The critical components of our strategy are as follows:

| ● | Advance the development of APTN-101 for the treatment of glioblastoma. The FDA’s acceptance in May 2023 of the IND for APTN-101 for the treatment of glioblastoma sets the stage for first-in-human clinical trials. |

| ● | Advance preclinical development of APTN-101 to support one or more additional INDs for additional kinds of cancer. We have designed APTN-101 to incorporate EGFRvIII, which is expressed on a number of tumor types, including breast and lung cancer (with or without brain metastases), so we are considering pre-clinical work to support INDs for these indications to be filed in 2026, if not earlier. |

8

| ● | Design and advance other early-stage drug product candidates for undisclosed rare and unmet needs. Because our proprietary technology enables drugs to cross barriers and target tissues, including the brain, we believe it has numerous potential applications in areas of unmet medical need. We are evaluating which of those indications would be most strategic to pursue in the near-term, and plan to initiate one or more preclinical studies in 2025 to support the filing of future INDs. |

| ● | Acquire, in-license or develop complementary delivery technologies that will allow us to produce BRiTE compounds or manipulate and activate immune cells in vivo. We continually evaluate technologies that will further enhance therapeutic effect, improve safety and manufacturability, or reduce costs of our products. |

| ● | Acquire targeted clinical compounds for conditions with unmet needs where our technology could be transformative. We continually evaluate development and in-licensing opportunities and may acquire clinical compounds for conditions with unmet medical needs where our technology’s ability to cross barriers and target specific tissues, including the brain, could be transformative of the treatment paradigm. |

| ● | Pursue a capital-efficient commercialization strategy. For products with smaller and/or orphan patient populations, our plan is to build an infrastructure to commercialize our drug products within the United Sates. Drawing upon our experience in commercializing specialty pharmaceutical products, we aim to build a specialized yet efficient infrastructure that will support the entire commercialization continuum, including stakeholder education, treatment decision and initiation, and product access throughout the patient journey. In addition, we plan to seek established companies to commercialize our drug products for larger addressable markets and outside of the United States. |

| ● | Leverage, protect and enhance our intellectual property portfolio and secure patents for additional products and indications. We intend to expand our intellectual property, grounded in securing composition of matter and method of use patents for new products and indications. We plan to enhance the intellectual property portfolio further through learnings from ongoing preclinical studies, clinical trials and manufacturing processes. |

| ● | Outsource capital-intensive operations. We plan to continue to outsource capital-intensive operations, including most clinical development and all manufacturing operations of our product candidates, and to facilitate the rapid development of our pipeline by using high quality specialist vendors and consultants in a capital efficient manner. |

Glioblastoma

Background

Glioblastoma multiforme (“GBM”), the highest grade (WHO IV) astrocytoma, is the most common and malignant brain tumor, accounting for about 50% of all gliomas and 12%–15% of all brain tumors. GBM tumor cells, which arise from stem cells or immature astrocytes due to genetic abnormalities, grow rapidly and disseminate in the brain. In addition, GBM cells can invade the intracranial blood vessels to areas away from the tumor core.

Although glioblastoma can happen anywhere in the brain, it usually forms in the frontal lobe and the temporal lobe. Glioblastoma rarely occurs in the brain stem or spinal cord. As glioblastoma grows, it spreads into the surrounding brain. This makes it difficult to remove the entire tumor with surgery. Although radiation therapy and chemotherapy can reach the tumors, glioblastoma cells can survive and regrow. Glioblastoma is very challenging to treat due to tumor-specific features, such as its rapid growth rate, the poor function of the immune system cells within the tumor, and inherent resistance of the tumor cells to many types of treatments.

There is no direct risk factor associated with most cases of glioblastoma. Certain rare genetic diseases, such as Li-Fraumeni and Lynch syndrome, are associated with gliomas. However, these affect only a small portion of patients with glioblastoma. Besides genetic syndromes, the only well-established risk factor is prior exposure to ionizing radiation that is used to treat certain head and neck cancers.

9

Brain tumor symptoms vary and depend on the tumor location. The most common glioblastoma symptoms are headaches, seizures, and progressively worsening numbness or weakness. Headaches with red flag symptoms warrant a trip to the doctor for a neurologic evaluation. Red flag symptoms include waking up due to pain, worsening pain on changing position, and continuous pain not relieved with over-the-counter headache medications.

Neurologic imaging with an MRI of the brain is often the first step in diagnosis. Brain imaging showing contrast-enhancing masses can be suggestive of glioblastoma. Most cases can be definitively diagnosed after surgery through histological testing. This takes place when a neuropathologist examines tissue or cells under a microscope to help confirm a glioblastoma diagnosis.

Incidence and Mortality

In the United States, the average annual age-adjusted incidence of glioblastoma is 3.2 per 100,000 population (or about 12,000 patients annually) with an average age of 64 at diagnosis. Glioblastoma is 1.6 times more common in males compared with females and 2.0 times higher in Caucasians compared to African Americans, with lower incidence in Asians and American Indians. Globally, glioblastoma incidence is highest in North America, Australia, and Northern and Western Europe. Veterans who served in Iraq or Afghanistan are 26% more likely to develop glioblastoma, according to the U.S. Department of Veterans Affairs and National Institutes of Health data, likely due to environmental exposures. Malignant primary brain tumors are the most frequent cause of cancer death in children, are more common than Hodgkin lymphoma, ovarian and testicular cancer and are responsible for more deaths than malignant melanoma.

Overall, the one-year relative survival rate is about 40% for patients diagnosed in the United States. The five-year survival rate is only about 5%. Treatment outcome remains poor, with a median survival rate of about 15 months.

Current Treatment/Management

A patient’s care team will take into account age, functional status, medical history and medication tolerability when planning the best treatment. For most newly diagnosed patients, the standard approach utilizes what is known as the Stupp protocol. Treatment is comprised of maximal surgical resection, which allows for accurate histological diagnosis, tumor genotyping, and a reduction in tumor volume, followed by 6 weeks of radiotherapy and concomitant daily temozolomide and a further 6 cycles of maintenance temozolomide. In patients with minimal functional impairment, the median overall survival (“OS”) is 15 months for radiotherapy plus temozolomide versus 12 months for radiotherapy alone.

Treatment options in the relapsed or recurrent setting are less well defined, with no established standard of care and little evidence for any interventions that prolong OS. Indeed, a significant proportion of patients may not even be eligible for second-line therapy. Options include further surgical resection, reirradiation, systemic therapies such as carmustine or bevacizumab, combined approaches, or supportive care alone.

Patients may also be treated with tumor treatment fields. This is a portable device placed on the scalp that uses mild electrical fields to try to interrupt cancer cell growth.

Standard-of-care treatments fail to specifically eliminate tumor cells and are limited by incapacitating damage to surrounding normal brain and systemic tissues leading to lymphopenia and many other detrimental side effects. All of this demonstrates that a more targeted immunotherapeutic approach is needed.

10

Over the last decade, emerging immunotherapies (such as monoclonal antibodies, oncolytic virus therapy, adoptive cell therapy, and cellular vaccines therapy) aimed at improving specific immune response against tumor cells have brought a glimmer of hope to patients with GBM. Adoptive cell therapy, including tumor-infiltrate lymphocytes (“TILs”) transfer and genetically engineered T cells transfer, is one of the most significant breakthroughs in the field of immune-oncology. Chimeric antigen receptor (“CAR”) engineered autologous T cells have produced sustained remissions in refractory lymphomas, but this approach needs further study in the treatment of solid tumors. While there is significant potential with targeted immunotherapy in GBM, significant challenges remain, including primarily the difficulty of crossing the BBB.

Bi-Specific Antibodies

The concept of bispecific antibodies was first introduced in 1980s as a method to target multiple antigens by a single antibody. The recombinant bispecific antibodies are classified into two types. The first are antibodies containing the crystallizable region (i.e., Fc-containing antibodies) and the second are antibody derivatives without Fc regions. The Fc region is the tail region of an antibody that interacts with cell surface receptors called Fc receptors and some proteins of the complement system. The mechanism of action of bispecific antibodies includes binding to the tumor cells on one side through the Fab (antigen-binding region) portion of the antibody against the tumor-specific antigen (such as CD19, HER2, EGFR, or GD2) and to the immune effector cells such as T cells and NK cells, which leads to activation of those immune effector cells and Fc-receptor bearing phagocytic cells such as monocytes/macrophages that can also mediate direct lysis of the tumor cells.

Bispecific antibodies termed bispecific T cell engagers (“BiTEs”) are monomeric proteins consisting of two antibody-derived single-chain variable fragments (“scFvs”) translated in tandem. These constructs possess one effector-binding arm specific for the epsilon subunit of T-cell CD3 and an opposing target-binding arm directed against an antigen that is expressed on the surface of tumor cells (e.g., EGFRvIII).

We believe EGFRvIII is an attractive target tumor specific antigen, in part because it is specific to cancer cells and is not expressed in non-tumor tissue. Importantly, antibodies directed against EGFRvIII are entirely tumor-specific and do not cross react with the wild-type receptor located on healthy cells. Therefore, by retargeting T cells against the tumor-specific EGFRvIII antigen, we believe we can avoid killing healthy tissue and the related adverse effects. EGFRs are involved in deregulated cancer signaling pathways, leading to atypical proliferation and growth of tumor cells. EGFRvIII is the most common variant not presented in a major histocompatibility complex (“MHC”) -dependent manner and is seen in approximately 31 to 50% of patients with GBM and in a broad array of other cancers including breast and lung carcinoma. Lung and breast carcinoma are the two main types of cancer that lead to secondary brain tumors (i.e., brain metastases) in about 25% of these patients. Among patients with EGFRvIII-positive GBM, 37 to 86% of tumor cells express the mutated receptor, indicating that the mutation is translated with significant consistency.

Among patients with GBM, expression of EGFRvIII is an independent, negative prognostic indicator. EGFRvIII also enhances the growth of neighboring EGFRvIII-negative tumor cells via cytokine-mediated paracrine signaling and by transferring a functionally active oncogenic receptor to EGFRvIII-negative cells through the release of lipid-raft related microvesicles. Recent research has also found that EGFRvIII is expressed in glioma stem cells, an important consideration given the paradigm that tumor stem cells represent a subpopulation of cells that give rise to all differentiated tumor cells. Altogether, the specificity, high frequency of surface expression and oncogenicity of the EGFRvIII mutation make it an ideal target for antibody-based immunotherapy.

The divalent structure of BiTEs brings T cells into close proximity to the tumor cell, creating a synapse. Following BiTE-mediated synapse formation, T cells proliferate, secrete pro-inflammatory cytokines and express surface activation markers. Following BiTE-mediated synapse formation, T cells release perforin and granzyme proteases that kill tumor cells. BiTEs are capable of mediating serial rounds of killing and can trigger specific tumor cell killing from naïve T cells at exceedingly low concentrations and effector-to-target ratios.

It is well established that certain gliomas, such as glioblastoma, are uniquely shielded from the immune system due to its location within the CNS. While this privilege is not absolute, a significant proportion of tumors have been noted to be devoid of any TILs that can be redirected by bispecific T-cell engagers. In those tumors that do demonstrate invasion by TILs, they are often induced to be dysfunctional and anergic by the suppressive tumor microenvironment. Increased numbers of intratumoral CD8+ cytotoxic T lymphocytes (“CTLs”) have been associated with favorable outcomes in patients with glioblastoma.

11

Concomitant administration of stimulated CTLs may therefore synergistically enhance the efficacy of this treatment. The migration of T-cell engagers across the BBB may also be facilitated by activated T cells which adhere to the brain microvascular endothelium and subsequently cross by diapedesis. Concurrent administration of activated functional T cells could therefore enhance the trafficking of bispecific T-cell engagers and other therapeutics into the intracranial compartment, increasing their density at the tumor site and thus the therapeutic effect.

Additionally, target cell killing with BiTE occurs in the absence of regular MHC peptide antigen recognition and costimulation and is therefore resistant to certain immune escape mechanisms affecting antigen presentation and those affecting generation of tumor-specific T cell clones. Because the CD3ε target of BiTE antibody construct is the same in CD8+ and CD4+ T cells of any phenotype, they are all engaged, leading to a polyclonal T cell activation, expansion and broad tumor cell killing.

Bispecific T-cell engagers offer immunotherapy in a manufacturing format which is both scalable and standardizable. In contrast to CAR T cells, T-cell engagers do not require initial lymphodepletion. Ex vivo manipulation of autologous cells has significant limitations, including the need for a centralized manufacturing infrastructure with extensively trained laboratory personnel to genetically modify each patient’s own T cells, use viral transduction which poses uncertain risks, are limited to the initial subset of T cells manipulated and infused, and still face uncertainty as to the optimal T cell phenotype to infuse.

Our Product Pipeline

APTN-101

We have recently reported the development of our first novel T cell engaging molecule, known as APTN-101, using our BRiTE technology. BRiTE focuses on the transport of difficult to deliver T cell targeting agents across the BBB allowing access to the immunoprivileged brain and overcoming the challenges with other immunotherapeutic approaches. This is accomplished by sequentially or simultaneously administering both BRiTE and specifically activated T cells by adoptive transfer. APTN-101 was designed to specifically redirect T cells against tumors expressing a well-characterized, mutated form of the EGFR, EGFRvIII, on a number of tumor types, including GBM. Because EGFRvIII is exclusively expressed on tumor cells, but not normal healthy cells, it represents an ideal target for immunotherapy.

APTN-101 (EGFRvIII x CD3 BRiTE) successfully activates human T cells against EGFRvIII expressing target cells, in the absence of any additional immunostimulatory signal, resulting in the secretion of Th-1-associated cytokines and tumor-cell killing. APTN-101 is similarly effective in vivo. Intravenous administration of APTN-101 induced consistent antitumor responses in mice bearing established, late-stage, aggressive, intracerebral patient-derived gliomas, rapidly achieving complete remission rates as high as 75% in the absence of apparent toxicity. Given the exquisite tumor-specificity of APTN-101, it represents a critical conceptual advance in safety contrary to target antigens having a promiscuous expression pattern.

The concept of BRiTE is the combination of novel T cell targeting agents with specifically activated polyclonal T cells. In order to exert antineoplastic affects against brain tumors, both the T cell targeting agent and T cells need to efficiently access areas that have long been considered as immunoprivileged. While circulating naïve T cells do not typically penetrate the CNS, activated T cells are known to cross the BBB to perform routine immunosurveillance of the central nervous system (Figure 1).

Figure 1- The process of T cells crossing the inflamed BBB is coordinating and sequential. Briefly, activated T cells initially arresting on the endothelium is mediated by the lymphocyte-associated antigen-1 (“LFA- 1”) and α4β1-integrin expressed on the T cells, respectively binding to the intracellular cell adhesion molecule 1 (“ICAM1”) and adhesion molecules vascular cell adhesion molecule 1 (“VCAM1”) on brain endothelial cells. Subsequently, the T cell crawling and polarization exclusively involve LFA-1 and ICAM1/2 interactions. After arriving at sites where are rich in the laminin isoform α4 but not laminin β5, the T cells use α6β1-integrin to traverse the endothelial basement membrane.

12

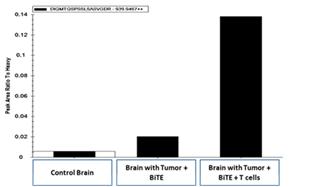

Upon intravenous administration, the T cell targeting agent (i.e., EGFRviii x CD3) binds to circulating T cells via its CD3 receptor and carries or “hitchhikes” the agent to tumors located behind the BBB. Studies in aggressive orthotopic GBM models have revealed that adoptive transfer of activated T cells significantly increases the biodistribution of intravenously administered EGFRvIII x CD3 BRiTE to orthotopic glioma (Figure 2).

Figure 2- Mass spectroscopy demonstrates that pre-administration (four days) of ex vivo activated T cells increases the biodistribution of intravenously administered EGFRvIII x CD3 to the brain parenchyma.

BRiTE circumvents ordinary clonotypic T-cell specificity, potentially allowing any T-cell, regardless of endogenous specificity or phenotype, to exert an anti-neoplastic effect. In vivo experiments show that BRiTEs can reactivate potentially unresponsive, anergic T cells, such as those frequently encountered among TIL populations thereby enhancing the spread of T cells reactive towards other antigens (epitope spreading). Proximal contact between T cells and tumor cells could directly reactivate tumor infiltrating lymphocytes specific for cancer antigens other than directed by BRiTE, without cross-presentation. The EGFRvIII x CD3 BRiTE molecule has the potential to directly activate and expand pre-existing T cells among a polyclonal population that are specific for tumor antigens other than EGFRvIII. Indeed, others have discovered that by re-activating pre-existing T cell clones using a CD3 binding bispecific antibody specific for Wilms’ tumor protein (WT1) it is possible to induce effective and persistent epitope spreading responses to multiple antigens. If the clinical utility of this mechanism of epitope spreading is confirmed, this could provide an exciting mechanism to combat tumor heterogeneity.

Importantly, our data suggest that once APTN-101 reaches the brain, it can activate even suppressive Tregs to kill glioblastoma tumor cells by redirecting their natural granzyme-mediated cytotoxic potential and enhance a cytotoxic immune response. These findings not only highlight a new mechanism by which BRiTEs may circumvent certain aspects of Treg mediated suppression, but also have broader implications with regard to the natural functional role of activated, tumor infiltrating Tregs that ordinarily suppress and kill cytotoxic T lymphocytes in the tumor microenvironment.

By tethering cytotoxic effectors to target cells without the need for antigen presentation via the MHC, BRiTEs can furthermore overcome tumor immune escape mechanisms, such as the downregulation of MHC.

13

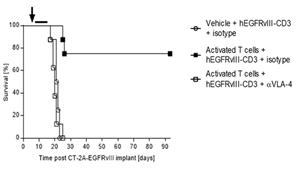

In addition to enhancing the biodistribution of EGFRvIII x CD3 BRiTE to the brain, the activated polyclonal T cells (compared to the addition of no activated polyclonal T cells or naïve polyclonal T cells) have the potential to restore effector T cells function at intracerebral sites (Figure 3) leading to cures in greater than 75% of animals.

Figure 3- IV administration of activated T cells enhances hEGFRvIII-CD3 bi-scFv efficacy against syngeneic, highly-invasive, orthotopic glioma (right panel) compared to IV administration of naïve T cells when combined with hEGFRvIII-CD3 bi-scFv (left panel). The highly invasive murine glioma CT-2A-EGFRvIII was implanted orthotopically in human CD3 transgenic mice (females, 8-10 weeks old, n=10 per group).

Next, we hypothesized that the increase in efficacy observed with the pre-administration of activated polyclonal T cells would be abrogated if those T cells were to be blocked from entering the CNS parenchyma. Natalizumab, a clinically approved drug for the treatment of multiple sclerosis, functions by binding to polyclonal T cells and preventing their association with receptors involved in the process of extravasation. Remarkably, in cohorts of mice receiving adoptive transfer of activated polyclonal T cells along with treatment with the extravasation blocking molecule natalizumab, efficacy was decreased to levels observed in cohorts that did not receive adoptive transfer of activated polyclonal T cells (Figure 4).

Figure 4- Blocking T cell extravasation with Natalizumab (αVLA-4) abrogates the observed increase in efficacy with adoptive cell transfer (n=8 per group). Natalizumab is a clinically approved drug for the treatment of multiple sclerosis that functions by blocking T cell extravasation.

We have also demonstrated an effective “antidote” for any potential toxicity that may result from administration of the EGFRvIII x CD3 BRiTE in a clinical setting. By administering a short peptide that spans the EGFRvIII mutation (PEPvIII), we have effectively blocked bispecific antibody function both in vitro and in vivo, providing a tool highly likely to aid in safe clinical administration of any EGFRvIII targeted bispecific antibody.

The above data demonstrates that BRiTE technology has the ability to transport difficult to deliver agents, including T cell targeting agents, across the BBB and demonstrate superior antineoplastic activity in aggressive orthotopic models of GBM while having an acceptable safety profile. This newly uncovered hitchhiking mechanism of drug delivery to the CNS provides an important tool to enhance the immunotherapy of brain tumors and has potentially far-reaching consequences for the treatment of other CNS disorders, such as Alzheimer’s or Parkinson’s disease, where issues regarding drug delivery to the CNS are relevant.

14

In summary, the results of preclinical studies demonstrate that the EGFRvIII targeting BRiTE may provide a safe, highly effective therapeutic option for GBM patients. Future studies will determine whether these results can be recapitulated in the clinical setting and whether BRiTEs favorably interact with other therapies that are currently employed as a standard-of-care for GBM patients.

APTN-101 Clinical Studies

The proposed Phase 1 study will evaluate a novel hEGFRvIII-CD3-biscFv Bispecific T cell engager (BRiTE) in patients diagnosed with pathologically documented supratentorial World Health Organization grade IV malignant glioma with an EGFR mutation (either newly diagnosed or at first progression/recurrence) at the Preston Robert Tisch Brain Tumor Center at Duke University.

The primary objective of this phase 1 study is to determine the safety and tolerability of BRiTE and recommend phase 2 dose of BRiTE injected with and without activated polyclonal T-cells in among a patient population that includes newly diagnosed patients after completion of standard of care therapy consisting of radiation and adjuvant temozolomide, and patients at first progression (defined as progression during or after standard of care radiation and adjuvant temozolomide).

Another secondary objective is to describe the PK in subjects treated with BRiTE. A population PK analysis will be performed to characterize the PK of BRiTE using the software Nonlinear Mixed Effects Modeling (NONMEM, version 7.2). Different structural PK models (e.g., 1 and 2 compartment) with linear or non-linear (e.g., Michaelis-Menten) kinetics will be fitted to the plasma concentration-time data of BRiTE.

Exploratory objectives include an evaluation of the pharmacodynamics effect of BRiTE, an evaluation of the formation and incidence of anti-BRiTE antibodies, and a description of overall survival and progression-free survival.

Our Intellectual Property

We strive to protect the proprietary technology that we believe is important to our business, including our product candidates and our processes. We seek patent protection in the United States and internationally for our product candidates, their methods of use and processes of manufacture, and any other technology to which we have rights, as appropriate. Additionally, we have licensed the rights to intellectual property related to certain of our product candidates, including patents and patent applications that cover the products or their methods of use or processes of manufacture. The terms of the licenses are described below under the heading “License Agreement.” We also rely on trade secrets that may be important to the development of our business.

We hold a world-wide exclusive license to three issued or allowed United States patents and one pending PTC patent application covering the enhanced delivery of drugs and other compounds to the brain and other tissues. The patents and patent applications that we licensed provide patent terms or anticipated patent terms ranging from 2031 to 2039 without patent term extensions.

Our success will in part depend on the ability to obtain and maintain patent and other proprietary rights in commercially important technology, inventions and know-how related to our business, the validity and enforceability of our patents, the continued confidentiality of our trade secrets, and our ability to operate without infringing the valid and enforceable patents and proprietary rights of third parties. We also rely on continuing technological innovation and in-licensing opportunities to develop and maintain our proprietary position.

We cannot be sure that patents will be granted with respect to any of our pending patent applications or with respect to any patent applications we may own or license in the future, nor can we be sure that any of our existing patents or any patents we may own or license in the future will be useful in protecting our technology and products. For this and more comprehensive risks related to our intellectual property, please see “Risk Factors—Risks Related to Our Intellectual Property.”

15

License Agreement

Patent License Agreement with Duke University

Effective January 11, 2023, Private Adaptin entered into a patent license agreement (the “Duke License”) with Duke University, a nonprofit educational and research institution organized under the laws of North Carolina (“Duke University”), whereby Duke University granted us an exclusive license with a right to grant sublicenses to “BISPECIFIC EGFRvIII ANTIBODY ENGAGING MOLECULES,” “HUMAN BISPECIFIC EGFRvIII ANTIBODY AND CD3 ENGAGING MOLECULES,” “CERTAIN IMPROVED HUMAN BISPECIFIC EGFRvIII ANTIBODY ENGAGING MOLECULES” and “ENHANCED DELIVERY OF DRUGS AND OTHER COMPOUNDS TO THE BRAIN AND OTHER TISSUES” (together, the “precision medicine technology”). With this technology, which the Company assumed pursuant to the Merger, we intend to develop our BRiTE Platform, a combination of an immune cell engager with activated functional T-cells, which focuses on transporting difficult to deliver agents across the blood brain barrier, allowing access to the immunoprivileged central nervous system. Under the Duke License, we are required to use commercially reasonable efforts to obtain and retain the relevant governmental approvals and to commercialize the precision medicine technology. We must also use reasonable efforts to reach certain commercialization and research and development milestones as outlined in the Duke License.

On August 8, 2024, Private Adaptin entered into a Sponsored Research Agreement (the “SRA”), which the Company assumed pursuant to the Merger, whereby Duke University agreed to perform research exploring the administration methods of our BRiTE Platform for a fixed fee. The Duke License has been amended (the “First Amendment”) such that the Company has the option to add any invention conceived as a result of the performance under the SRA to the license.

As part of the consideration for the license, Private Adaptin issued Duke University shares, representing 5% of its issued and outstanding common stock on a fully diluted basis. Following the Merger, Duke University holds 2.0% of the combined Company. We also agreed to make payments based on clinical and commercial milestones and continuing royalty payments on any sales made after approval by regulatory authorities. These milestones include initiation of a Phase II or Phase III clinical trials, submission of applications for market approval in multiple jurisdictions including the United States, European Union and Japan and the initiation of post-approval commercial sales in the same jurisdictions. Based on an assumption that all milestones related to the current development program are met during the course of the Duke License, these milestone payments would total approximately $11.7 million. Under the terms of the Duke License, we must pay running royalties equal to low- to mid-single digit percentages of annual net sales, depending on the level of sales by us, our sublicensees and affiliates in that year, and subject to downward adjustment to low single digit percentages of our net annual sales in the event there is no valid claim of a patent for the product, with minimum annual royalty levels established. We also must pay Duke University low to mid-double-digit percentages of any sublicensing fees as set forth in the Duke License. We will be responsible for all patent expenses incurred by Duke University and must reimburse Duke University for previous patent expenses incurred by Duke University for filing and prosecution of the patent rights.

The term of the Duke License will extend until the expiration of the last to expire patent rights, subject to early termination as set forth in the Duke License. The foregoing descriptions of the Duke License, First Amendment and SRA do not purport to be complete and are qualified in their entirety by the terms and conditions of the Duke License, First Amendment and SRA, forms of which are attached hereto as Exhibits 10.1, 10.2 and 10.3, respectively, and are incorporated herein by reference.

Manufacturing and Supply

We contract with third parties for the manufacturing of all of our product candidates, and for pre-clinical and clinical studies and intend to continue to do so in the future. We do not own or operate any manufacturing facilities and we have no plans to build any owned clinical or commercial-scale manufacturing capabilities. We believe that the use of contract manufacturing organizations (“CMOs”) eliminates the need to directly invest in manufacturing facilities, equipment and additional staff. Although we rely on contract manufacturers, our personnel and consultants have extensive manufacturing experience overseeing CMOs.

16

We have produced the EGFRvIII x CD3 BRiTE in a fashion suitable for clinical translational and compatible with clinical biologic manufacturing infrastructure. This has included generating and certifying a Master Cell Bank and developing a scalable expression and tag-free purification and formulation process suitable for clinical translation. On the basis of our data and development work, we have had a CMO produce clinical-grade EGFRvIII x CD3 BRiTE suitable for clinical study.

As we further develop our product candidates, we expect to consider secondary or back-up manufacturers for both active pharmaceutical ingredient and drug product manufacturing. To date, our third-party manufacturers have met the manufacturing requirements for our product candidates in a timely manner. We expect third-party manufacturers to be capable of providing sufficient quantities of our product candidates to meet anticipated full-scale commercial demand but we have not assessed these capabilities beyond the supply of clinical materials to date. We currently engage CMOs on a “fee for services” basis based on our current development plans. We plan to identify CMOs and enter into longer-term contracts or commitments if and as we move our product candidates into Phase 3 clinical trials.

We believe alternate sources of manufacturing will be available to satisfy our clinical and potential future commercial requirements; however, we cannot guarantee that identifying and establishing alternative relationships with such sources will be successful, cost-effective, or completed on a timely basis without significant delay in the development or commercialization of our product candidates. All of the vendors we use are required to conduct their operations under current Good Manufacturing Practices (“cGMP”), a regulatory standard for the manufacture of pharmaceuticals.

Competition

The pharmaceutical industry is highly competitive and characterized by intense and rapidly changing competition to develop new technologies and proprietary products, particularly in some of the areas of high unmet medical need that we are targeting. Our potential competitors include both major and specialty pharmaceutical and biotechnology companies worldwide, many of which have far greater resources and access to capital than we do. In particular, Affimed N.V. and NexImmune, Inc. are studying the combination of immune cell engagers with T or NK cells using a different bispecific immune cell engager, and Amgen Inc. and Genentech, Inc. (a wholly-owned subsidiary of Roche Holding AG) have programs using a form of EGFRvIII x CD3 bispecific T cell engager (although neither are using them in combination with activated T cells). Our success will be based in part on our ability to identify, develop, and manage a portfolio of safe and effective product candidates that address the unmet needs of patients before our competitors.

Government Regulations

The FDA and other regulatory authorities at federal, state and local levels, as well as in foreign countries, extensively regulate, among other things, the research, development, testing, manufacture, quality control, import, export, safety, effectiveness, labeling, packaging, storage, distribution, record keeping, approval, advertising, promotion, marketing, post-approval monitoring and post-approval reporting of drugs, such as those we are developing. Along with our third-party contractors, we will be required to navigate the various preclinical, clinical, and commercial approval requirements of the governing regulatory agencies of the countries in which we wish to conduct studies or seek approval or licensure of our product candidates. The process of obtaining regulatory approvals and the subsequent compliance with appropriate federal, state, local, and foreign statutes and regulations require the expenditure of substantial time and financial resources.

FDA Regulation of Drugs

Before any of our drug product candidates may be marketed in the United States, they must be approved by the FDA. The process required by the FDA before drug product candidates may be marketed in the United States generally involves the following:

| ● | completion of preclinical laboratory tests and animal studies performed in accordance with the FDA’s current Good Laboratory Practices regulations; |

17

| ● | submission to the FDA of an IND, which must become effective before human clinical trials may begin and must be updated annually or when significant changes are made; |

| ● | approval by an independent institutional review board (“IRB”) or ethics committee for each clinical site before a clinical trial can begin; |

| ● | performance of adequate and well-controlled human clinical trials to establish the safety and efficacy of the proposed product candidate for its intended purpose; |

| ● | preparation of and submission to the FDA of a New Drug Application (“NDA”) after completion of all required clinical trials; |

| ● | a determination by the FDA within 60 days of its receipt of an NDA to file the application for review; |

| ● | satisfactory completion of an FDA Advisory Committee review, if required by the FDA; |

| ● | satisfactory completion of an FDA pre-approval inspection of the manufacturing facility or facilities at which the proposed product is produced to assess compliance with cGMP, and to assure that the facilities, methods, and controls are adequate to preserve the product’s continued safety, purity and potency, and of selected clinical investigational sites to assess compliance with current Good Clinical Practices; and |

| ● | FDA review and approval of the NDA to permit commercial marketing of the product for particular indications for use in the United States, which must be updated annually and when significant changes are made. |