10-K: Annual report [Section 13 and 15(d), not S-K Item 405]

Published on April 15, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the fiscal year ended

OR

For the transition period from __________ to __________

Commission file number:

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

|

|

| ||

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including

area code:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| N/A |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.0001 par value per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer,

as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports

pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter

period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically

every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Smaller reporting company | Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on

and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section

404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section

12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction

of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as

defined in Rule 12b-2 of the Act). Yes ☐ No

As of June 30, 2024, the last business day of the registrant’s

most recently completed second fiscal quarter, there were

As of March 31, 2025,

Documents Incorporated by Reference

Not applicable.

TABLE OF CONTENTS

i

EXPLANATORY NOTE

As used in this Annual Report on Form 10-K (this “Report”), unless otherwise stated or the context clearly indicates otherwise, the terms “Adaptin,” the “Company,” “we,” “us” and “our” refer to Adaptin Bio, Inc., incorporated in the State of Delaware, and its subsidiaries after giving effect to the Merger (as defined below) and the company name change described herein.

The registrant was incorporated as Unite Acquisition 1 Corp. (“Unite Acquisition”) in the State of Delaware on March 10, 2022. Prior to the Merger (as defined below), the registrant was a “shell company” (as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)).

On February 11, 2025, Unite Acquisition’s wholly owned subsidiary, Adaptin Acquisition Co., a Delaware corporation formed in the State of Delaware on January 30, 2025 (“Merger Sub”), merged with and into Adaptin Bio, Inc., a privately held Delaware corporation (“Private Adaptin”) formerly known as Centaur Bio Inc. Pursuant to this transaction (the “Merger”), Private Adaptin was the surviving corporation and became the Company’s wholly-owned subsidiary, and all of the outstanding stock of Private Adaptin was converted into shares of the combined Company’s common stock, par value $0.0001 per share (the “Common Stock”). In addition, in connection with the Merger, all of Private Adaptin’s outstanding convertible promissory notes converted into shares of Common Stock at $3.30 per share and all of Private Adaptin’s outstanding warrants became exercisable for shares of Common Stock. The Merger is expected to be accounted for as a reverse recapitalization in accordance with U.S. generally accepted accounting principles (“GAAP”).

As a result of the Merger, we acquired the business of Private Adaptin and continue its business operations as a public reporting company under the same name, Adaptin Bio, Inc. Concurrent with the consummation of the Merger, Private Adaptin changed its name to “Adaptin Bio Operating Corporation.”

The audited financial statements included herein are those of Unite Acquisition prior to the consummation of the Merger and the name change. Prior to the Merger, Unite Acquisition neither engaged in any operations nor generated any revenue. Until the Merger, based on Unite Acquisition’s business activities, Unite Acquisition was a “shell company” as defined under the Exchange Act.

The audited consolidated financial statements of Private Adaptin prior to the close of the Merger for the years ended December 31, 2024 and 2023, which is considered the Company’s accounting predecessor, are included in our Amendment No. 1 on Form 8-K/A filed with the SEC on April 15, 2025.

Unless otherwise provided below, this Report principally describes the business and operations of the Company following the Merger, other than the audited financial statements included herein and related Management’s Discussion and Analysis of Financial Condition and Results of Operations of Unite Acquisition prior to the Merger.

ii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Report includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Exchange Act. Forward-looking statements relate to, among others, our plans, objectives and expectations for our business, operations and financial performance and condition, and can be identified by terminology such as “may,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “will,” “could,” “project,” “target,” “potential,” “continue” and similar expressions that do not relate solely to historical matters. Forward-looking statements are based on management’s belief and assumptions and on information currently available to management. Although we believe that the expectations reflected in forward-looking statements are reasonable, such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by forward-looking statements.

Forward-looking statements include, but are not limited to, statements about:

| ● | our ability to raise additional money to fund our operations for at least the next twelve months as a going concern; |

| ● | our ability to develop our current and any future product candidates; |

| ● | our ability to receive marketing approval from the U.S. Food and Drug Administration (“FDA”) for our product candidates; |

| ● | our ability to maintain our license rights to our intellectual property and to adequately protect or enforce our intellectual property rights; |

| ● | our reliance on third parties to supply drug substance and drug product for our clinical trials and preclinical studies, and produce commercial supplies of product candidates; |

| ● | our ability to market and commercialize our products, if approved; |

| ● | our product candidates’ ability to achieve market acceptance, if approved; |

| ● | developments and projections relating to our competitors and our industry; |

| ● | our ability to adequately control the costs associated with our operations; |

| ● | our dependence on third-party reimbursement for commercial viability; |

| ● | the impact of current and future laws and regulations, especially those related to drug development and drug pricing controls; |

| ● | potential cybersecurity risks to our operational systems, infrastructure, and integrated software by us or third-party vendors; and |

| ● | the development of a market for our Common Stock. |

We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, operating results, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, the future events and trends discussed in this Report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

iii

PART I

ITEM 1. BUSINESS.

Our Company

The Company is a Delaware corporation initially formed in March 2022 as Unite Acquisition 1 Corp. Effective February 11, 2025, Unite Acquisition’s wholly-owned subsidiary, Merger Sub, merged with and into Private Adaptin, a Delaware corporation. Private Adaptin was the surviving corporation in the Merger and became Unite Acquisition’s wholly-owned subsidiary, renamed as Adaptin Operating Co. At the same time, Unite Acquisition changed its name to Adaptin Bio, Inc.

The Company’s website address is www.adaptinbio.com and we can be contacted at info@adaptinbio.com. Information contained on, or that can be accessed through, our website is not a part of this Report.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act, or the JOBS Act, and, for as long as we continue to be an emerging growth company, we may choose to take advantage of exemptions from various reporting requirements applicable to other public companies but not to emerging growth companies, including:

| ● | not being required to have our independent registered public accounting firm audit our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act; |

| ● | reduced disclosure obligations regarding executive compensation in our periodic reports and annual report on Form 10-K; and |

| ● | exemptions from the requirements of holding non-binding advisory votes on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

Our status as an emerging growth company will end upon the earlier of: (a) the fifth anniversary of the first sale of our common equity securities pursuant to an effective registration statement; (b) the last day of the fiscal year in which we have more than $1.235 billion in annual gross revenues; (c) the date we qualify as a “large accelerated filer,” with at least $700 million of equity securities held by non-affiliates; and (d) the date on which we have issued, in any three-year period, more than $1 billion in non-convertible debt securities.

Under the JOBS Act, emerging growth companies can also delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected to avail ourselves of this provision of the JOBS Act. As a result, we will not be subject to new or revised accounting standards at the same time as other public companies that are not emerging growth companies. Therefore, our consolidated financial statements may not be comparable to those of companies that comply with new or revised accounting pronouncements as of public company effective dates.

We are also a “smaller reporting company” as defined in the Exchange Act. We may continue to be a “smaller reporting company” even after we are no longer an emerging growth company. We may take advantage of certain of the scaled disclosures available to smaller reporting companies and will be able to take advantage of these scaled disclosures for so long as our voting and non-voting Common Stock held by non-affiliates is less than $250 million measured on the last business day of our second fiscal quarter, or our annual revenues is less than $100 million during the most recently completed fiscal year and our voting and non-voting Common Stock held by non-affiliates is less than $700 million measured on the last business day of our second fiscal quarter.

Business Overview

Adaptin is a biopharmaceutical company pioneering a transformational approach to enhance the transfer of therapeutics into the brain, facilitating the treatment of brain cancers and other unmet medical conditions. The Company’s proprietary technology harnesses the human immune system’s ability to target, recognize, destroy or deliver therapeutics to specific cells, including cancer cells. Our mission is to be the global leader and pioneer of this new treatment paradigm, integrating recombinant technology, gene therapy and cell therapy to address the challenges of targeting and delivering effective therapies, including to the brain for cancer and other central nervous system (“CNS”) indications.

The cause(s), or etiology, of many diseases can be addressed in part through manipulation of engineered cells. We view targeted manipulation of the human immune system, together with recombinant technology and/or gene therapy, as a therapeutically disruptive transformation in the way we treat brain and other diseases. Our lead product candidate has been recently accepted under an investigator-led IND to begin first-in-human studies in brain cancer. Assuming success of those studies, our experienced group of scientists and business leaders intend to develop our proprietary in vivo and ex vivo technology platforms to revolutionize treatment across a broad array of other therapeutic areas with unmet treatment needs, including CNS disorders, autoimmune disease and cardiovascular diseases, among others. Pursuing other therapeutic areas will likely require us to either raise a significant amount of additional capital or to engage in strategic transactions such as spin-offs or out-licenses. Our goal is to complete preclinical studies on additional product candidates and file multiple investigational new drug applications (each, an “IND”) in 2026, if not earlier.

1

Adaptin’s novel technology was originally developed by researchers in the Department of Neurosurgery at Duke University, led by Dr. John H. Sampson, the prior Robert H. and Gloria Wilkins Distinguished Professor and Chair of the Department of Neurosurgery and currently the Dean and Vice Chancellor at the University of Colorado School of Medicine. The group recognized that adoptive transfer of specifically activated functional human immune cells significantly increases the “hitchhiking” and intracerebral accumulation of macromolecules that are bound to their surface. While circulating naïve T cells do not typically penetrate the CNS, activated T cells are known to traffic frequently past the blood brain barrier (“BBB”) and perform routine immune surveillance in the CNS. Adaptin and its collaborators at Duke University are taking advantage of this CNS trafficking to enhance the localization of macromolecules and other agents to the CNS for cancer and other CNS disorders.

Adaptin is closely working with researchers at Duke University to translate preclinical proof of concept data of its first proprietary platform technology called BRiTE (Brain Bispecific T-cell Engager) into human clinical trials. BRiTE focuses on the transport of difficult to deliver T cell targeting agents to tumor tissue, including in the immunoprivileged brain and overcoming the challenges with other immunotherapeutic approaches. BRiTE is a translatable method to specifically target malignant glioma using a tumor-specific, fully human bispecific antibody that redirects patients’ own T cells to recognize and destroy tumor cells.

The first application of Adaptin’s technology is APTN-101, a proprietary epidermal growth factor receptor variant III, or EGFRVIII, BRiTE in order to eliminate malignant glioma tumors in a variety of aggressive preclinical tumor models where the tumor is implanted behind the BBB in the CNS (i.e., orthotopic). We designed APTN-101 to specifically redirect T cells against tumors expressing a well-characterized, mutated form of epidermal growth factor receptors (“EGFRs”) known as EGFRVIII, on a number of tumor types, including glioblastoma, breast and lung cancer. Because EGFRVIII is exclusively expressed on tumor cells, but not normal healthy cells, we believe it represents an ideal target for immunotherapy. We have made significant progress towards first-in-human clinical studies, including:

| ● | A pre-IND meeting with the FDA outlining a clear path to filing an IND; |

| ● | Completion of single-dose IND-enabling preclinical studies; |

| ● | Submission in April 2023 of an IND for an investigator-initiated, single-dose clinical trial, and its acceptance in May 2023 by the FDA; and |

| ● | Manufacturing of APTN-101 in more than sufficient quantities for Phase 1 trials. |

We also expect to expand our proprietary platform to other targets and indications. The Company is exploring several external opportunities to continue to advance and expand the product pipeline.

Strategy

Our goal is to become a leading biopharmaceutical company focused on the transfer of drugs across barriers and to targeted tissues, including the brain and CNS, to transform current treatment paradigms for patients and address unmet medical needs. The critical components of our strategy are as follows:

| ● | Advance the development of APTN-101 for the treatment of glioblastoma. The FDA’s acceptance in May 2023 of the IND for APTN-101 for the treatment of glioblastoma sets the stage for first-in-human clinical trials. |

| ● | Advance preclinical development of APTN-101 to support one or more additional INDs for additional kinds of cancer. We have designed APTN-101 to incorporate EGFRvIII, which is expressed on a number of tumor types, including breast and lung cancer (with or without brain metastases), so we are considering pre-clinical work to support INDs for these indications to be filed in 2026, if not earlier. |

| ● | Design and advance other early-stage drug product candidates for undisclosed rare and unmet needs. Because our proprietary technology enables drugs to cross barriers and target tissues, including the brain, we believe it has numerous potential applications in areas of unmet medical need. We are evaluating which of those indications would be most strategic to pursue in the near-term, and plan to initiate one or more preclinical studies in 2025 to support the filing of future INDs. |

2

| ● | Acquire, in-license or develop complementary delivery technologies that will allow us to produce BRiTE compounds or manipulate and activate immune cells in vivo. We continually evaluate technologies that will further enhance therapeutic effect, improve safety and manufacturability, or reduce costs of our products. |

| ● | Acquire targeted clinical compounds for conditions with unmet needs where our technology could be transformative. We continually evaluate development and in-licensing opportunities and may acquire clinical compounds for conditions with unmet medical needs where our technology’s ability to cross barriers and target specific tissues, including the brain, could be transformative of the treatment paradigm. |

| ● | Pursue a capital-efficient commercialization strategy. For products with smaller and/or orphan patient populations, our plan is to build an infrastructure to commercialize our drug products within the United Sates. Drawing upon our experience in commercializing specialty pharmaceutical products, we aim to build a specialized yet efficient infrastructure that will support the entire commercialization continuum, including stakeholder education, treatment decision and initiation, and product access throughout the patient journey. In addition, we plan to seek established companies to commercialize our drug products for larger addressable markets and outside of the United States. |

| ● | Leverage, protect and enhance our intellectual property portfolio and secure patents for additional products and indications. We intend to expand our intellectual property, grounded in securing composition of matter and method of use patents for new products and indications. We plan to enhance the intellectual property portfolio further through learnings from ongoing preclinical studies, clinical trials and manufacturing processes. |

| ● | Outsource capital-intensive operations. We plan to continue to outsource capital-intensive operations, including most clinical development and all manufacturing operations of our product candidates, and to facilitate the rapid development of our pipeline by using high quality specialist vendors and consultants in a capital efficient manner. |

Glioblastoma

Background

Glioblastoma multiforme (“GBM”), the highest grade (World Health Organization (“WHO”) grade IV) astrocytoma, is the most common and malignant brain tumor, accounting for about 50% of all gliomas and 12%-15% of all brain tumors. GBM tumor cells, which arise from stem cells or immature astrocytes due to genetic abnormalities, grow rapidly and disseminate in the brain. In addition, GBM cells can invade the intracranial blood vessels to areas away from the tumor core.

Although glioblastoma can happen anywhere in the brain, it usually forms in the frontal lobe and the temporal lobe. Glioblastoma rarely occurs in the brain stem or spinal cord. As glioblastoma grows, it spreads into the surrounding brain. This makes it difficult to remove the entire tumor with surgery. Although radiation therapy and chemotherapy can reach the tumors, glioblastoma cells can survive and regrow. Glioblastoma is very challenging to treat due to tumor-specific features, such as its rapid growth rate, the poor function of the immune system cells within the tumor, and inherent resistance of the tumor cells to many types of treatments.

There is no direct risk factor associated with most cases of glioblastoma. Certain rare genetic diseases, such as Li-Fraumeni and Lynch syndrome, are associated with gliomas. However, these affect only a small portion of patients with glioblastoma. Besides genetic syndromes, the only well-established risk factor is prior exposure to ionizing radiation that is used to treat certain head and neck cancers.

Brain tumor symptoms vary and depend on the tumor location. The most common glioblastoma symptoms are headaches, seizures, and progressively worsening numbness or weakness. Headaches with red flag symptoms warrant a trip to the doctor for a neurologic evaluation. Red flag symptoms include waking up due to pain, worsening pain on changing position, and continuous pain not relieved with over-the-counter headache medications.

Neurologic imaging with an MRI of the brain is often the first step in diagnosis. Brain imaging showing contrast-enhancing masses can be suggestive of glioblastoma. Most cases can be definitively diagnosed after surgery through histological testing. This takes place when a neuropathologist examines tissue or cells under a microscope to help confirm a glioblastoma diagnosis.

3

Incidence and Mortality

In the United States, the average annual age-adjusted incidence of glioblastoma is 3.2 per 100,000 population (or about 12,000 patients annually) with an average age of 64 at diagnosis. Glioblastoma is 1.6 times more common in males compared with females and 2.0 times higher in Caucasians compared to African Americans, with lower incidence in Asians and American Indians. Globally, glioblastoma incidence is highest in North America, Australia, and Northern and Western Europe. Veterans who served in Iraq or Afghanistan are 26% more likely to develop glioblastoma, according to the U.S. Department of Veterans Affairs and National Institutes of Health data, likely due to environmental exposures. Malignant primary brain tumors are the most frequent cause of cancer death in children, are more common than Hodgkin lymphoma, ovarian and testicular cancer and are responsible for more deaths than malignant melanoma.

Overall, the one-year relative survival rate is about 40% for patients diagnosed in the United States. The five-year survival rate is only about 5%. Treatment outcome remains poor, with a median survival rate of about 15 months.

Current Treatment/Management

A patient’s care team will take into account age, functional status, medical history and medication tolerability when planning the best treatment. For most newly diagnosed patients, the standard approach utilizes what is known as the Stupp protocol. Treatment is comprised of maximal surgical resection, which allows for accurate histological diagnosis, tumor genotyping, and a reduction in tumor volume, followed by 6 weeks of radiotherapy and concomitant daily temozolomide and a further 6 cycles of maintenance temozolomide. In patients with minimal functional impairment, the median overall survival (“OS”) is 15 months for radiotherapy plus temozolomide versus 12 months for radiotherapy alone.

Treatment options in the relapsed or recurrent setting are less well defined, with no established standard of care and little evidence for any interventions that prolong OS. Indeed, a significant proportion of patients may not even be eligible for second-line therapy. Options include further surgical resection, reirradiation, systemic therapies such as carmustine or bevacizumab, combined approaches, or supportive care alone.

Patients may also be treated with tumor treatment fields. This is a portable device placed on the scalp that uses mild electrical fields to try to interrupt cancer cell growth.

Standard-of-care treatments fail to specifically eliminate tumor cells and are limited by incapacitating damage to surrounding normal brain and systemic tissues leading to lymphopenia and many other detrimental side effects. All of this demonstrates that a more targeted immunotherapeutic approach is needed. Over the last decade, emerging immunotherapies (such as monoclonal antibodies, oncolytic virus therapy, adoptive cell therapy, and cellular vaccines therapy) aimed at improving specific immune response against tumor cells have brought a glimmer of hope to patients with GBM. Adoptive cell therapy, including tumor-infiltrate lymphocytes (“TILs”) transfer and genetically engineered T cells transfer, is one of the most significant breakthroughs in the field of immune-oncology. Chimeric antigen receptor (“CAR”) engineered autologous T cells have produced sustained remissions in refractory lymphomas, but this approach needs further study in the treatment of solid tumors. While there is significant potential with targeted immunotherapy in GBM, significant challenges remain, including primarily the difficulty of crossing the BBB.

Bi-Specific Antibodies

The concept of bispecific antibodies was first introduced in 1980s as a method to target multiple antigens by a single antibody. The recombinant bispecific antibodies are classified into two types. The first are antibodies containing the crystallizable region (i.e., Fc-containing antibodies) and the second are antibody derivatives without Fc regions. The Fc region is the tail region of an antibody that interacts with cell surface receptors called Fc receptors and some proteins of the complement system. The mechanism of action of bispecific antibodies includes binding to the tumor cells on one side through the Fab (antigen-binding region) portion of the antibody against the tumor-specific antigen (such as CD19, HER2, EGFR, or GD2) and to the immune effector cells such as T cells and NK cells, which leads to activation of those immune effector cells and Fc-receptor bearing phagocytic cells such as monocytes/macrophages that can also mediate direct lysis of the tumor cells.

Bispecific antibodies termed bispecific T cell engagers (“BiTEs”) are monomeric proteins consisting of two antibody-derived single-chain variable fragments (“scFvs”) translated in tandem. These constructs possess one effector-binding arm specific for the epsilon subunit of T-cell CD3 and an opposing target-binding arm directed against an antigen that is expressed on the surface of tumor cells (e.g., EGFRvIII).

4

We believe EGFRvIII is an attractive target tumor specific antigen, in part because it is specific to cancer cells and is not expressed in non-tumor tissue. Importantly, antibodies directed against EGFRvIII are entirely tumor-specific and do not cross react with the wild-type receptor located on healthy cells. Therefore, by retargeting T cells against the tumor-specific EGFRvIII antigen, we believe we can avoid killing healthy tissue and the related adverse effects. EGFRs are involved in deregulated cancer signaling pathways, leading to atypical proliferation and growth of tumor cells. EGFRvIII is the most common variant not presented in a major histocompatibility complex (“MHC”) -dependent manner and is seen in approximately 31 to 50% of patients with GBM and in a broad array of other cancers including breast and lung carcinoma. Lung and breast carcinoma are the two main types of cancer that lead to secondary brain tumors (i.e., brain metastases) in about 25% of these patients. Among patients with EGFRvIII-positive GBM, 37 to 86% of tumor cells express the mutated receptor, indicating that the mutation is translated with significant consistency.

Among patients with GBM, expression of EGFRvIII is an independent, negative prognostic indicator. EGFRvIII also enhances the growth of neighboring EGFRvIII-negative tumor cells via cytokine-mediated paracrine signaling and by transferring a functionally active oncogenic receptor to EGFRvIII-negative cells through the release of lipid-raft related microvesicles. Recent research has also found that EGFRvIII is expressed in glioma stem cells, an important consideration given the paradigm that tumor stem cells represent a subpopulation of cells that give rise to all differentiated tumor cells. Altogether, the specificity, high frequency of surface expression and oncogenicity of the EGFRvIII mutation make it an ideal target for antibody-based immunotherapy.

The divalent structure of BiTEs brings T cells into close proximity to the tumor cell, creating a synapse. Following BiTE-mediated synapse formation, T cells proliferate, secrete pro-inflammatory cytokines and express surface activation markers. Following BiTE-mediated synapse formation, T cells release perforin and granzyme proteases that kill tumor cells. BiTEs are capable of mediating serial rounds of killing and can trigger specific tumor cell killing from naïve T cells at exceedingly low concentrations and effector-to-target ratios.

It is well established that certain gliomas, such as glioblastoma, are uniquely shielded from the immune system due to its location within the CNS. While this privilege is not absolute, a significant proportion of tumors have been noted to be devoid of any TILs that can be redirected by bispecific T-cell engagers. In those tumors that do demonstrate invasion by TILs, they are often induced to be dysfunctional and anergic by the suppressive tumor microenvironment. Increased numbers of intratumoral CD8+ cytotoxic T lymphocytes (“CTLs”) have been associated with favorable outcomes in patients with glioblastoma.

Concomitant administration of stimulated CTLs may therefore synergistically enhance the efficacy of this treatment. The migration of T-cell engagers across the BBB may also be facilitated by activated T cells which adhere to the brain microvascular endothelium and subsequently cross by diapedesis. Concurrent administration of activated functional T cells could therefore enhance the trafficking of bispecific T-cell engagers and other therapeutics into the intracranial compartment, increasing their density at the tumor site and thus the therapeutic effect.

Additionally, target cell killing with BiTE occurs in the absence of regular MHC peptide antigen recognition and costimulation and is therefore resistant to certain immune escape mechanisms affecting antigen presentation and those affecting generation of tumor-specific T cell clones. Because the CD3ε target of BiTE antibody construct is the same in CD8+ and CD4+ T cells of any phenotype, they are all engaged, leading to a polyclonal T cell activation, expansion and broad tumor cell killing.

Bispecific T-cell engagers offer immunotherapy in a manufacturing format which is both scalable and standardizable. In contrast to CAR T cells, T-cell engagers do not require initial lymphodepletion. Ex vivo manipulation of autologous cells has significant limitations, including the need for a centralized manufacturing infrastructure with extensively trained laboratory personnel to genetically modify each patient’s own T cells, use viral transduction which poses uncertain risks, are limited to the initial subset of T cells manipulated and infused, and still face uncertainty as to the optimal T cell phenotype to infuse.

Our Product Pipeline

APTN-101

We have recently reported the development of our first novel T cell engaging molecule, known as APTN-101, using our BRiTE technology. BRiTE focuses on the transport of difficult to deliver T cell targeting agents across the BBB allowing access to the immunoprivileged brain and overcoming the challenges with other immunotherapeutic approaches. This is accomplished by sequentially or simultaneously administering both BRiTE and specifically activated T cells by adoptive transfer. APTN-101 was designed to specifically redirect T cells against tumors expressing a well-characterized, mutated form of the EGFR, EGFRvIII, on a number of tumor types, including GBM. Because EGFRvIII is exclusively expressed on tumor cells, but not normal healthy cells, it represents an ideal target for immunotherapy.

5

APTN-101 (EGFRvIII x CD3 BRiTE) successfully activates human T cells against EGFRvIII expressing target cells, in the absence of any additional immunostimulatory signal, resulting in the secretion of Th-1-associated cytokines and tumor-cell killing. APTN-101 is similarly effective in vivo. Intravenous administration of APTN-101 induced consistent antitumor responses in mice bearing established, late-stage, aggressive, intracerebral patient-derived gliomas, rapidly achieving complete remission rates as high as 75% in the absence of apparent toxicity. Given the exquisite tumor-specificity of APTN-101, it represents a critical conceptual advance in safety contrary to target antigens having a promiscuous expression pattern.

The concept of BRiTE is the combination of novel T cell targeting agents with specifically activated polyclonal T cells. In order to exert antineoplastic affects against brain tumors, both the T cell targeting agent and T cells need to efficiently access areas that have long been considered as immunoprivileged. While circulating naïve T cells do not typically penetrate the CNS, activated T cells are known to cross the BBB to perform routine immunosurveillance of the central nervous system (Figure 1).

Figure 1- The process of T cells crossing the inflamed BBB is coordinating and sequential. Briefly, activated T cells initially arresting on the endothelium is mediated by the lymphocyte-associated antigen-1 (“LFA- 1”) and α4β1-integrin expressed on the T cells, respectively binding to the intracellular cell adhesion molecule 1 (“ICAM1”) and adhesion molecules vascular cell adhesion molecule 1 (“VCAM1”) on brain endothelial cells. Subsequently, the T cell crawling and polarization exclusively involve LFA-1 and ICAM1/2 interactions. After arriving at sites where are rich in the laminin isoform α4 but not laminin β5, the T cells use α6β1-integrin to traverse the endothelial basement membrane.

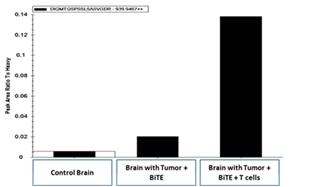

Upon intravenous administration, the T cell targeting agent (i.e., EGFRviii x CD3) binds to circulating T cells via its CD3 receptor and carries or “hitchhikes” the agent to tumors located behind the BBB. Studies in aggressive orthotopic GBM models have revealed that adoptive transfer of activated T cells significantly increases the biodistribution of intravenously administered EGFRvIII x CD3 BRiTE to orthotopic glioma (Figure 2).

Figure 2- Mass spectroscopy demonstrates that pre-administration (four days) of ex vivo activated T cells increases the biodistribution of intravenously administered EGFRvIII x CD3 to the brain parenchyma.

BRiTE circumvents ordinary clonotypic T-cell specificity, potentially allowing any T-cell, regardless of endogenous specificity or phenotype, to exert an anti-neoplastic effect. In vivo experiments show that BRiTEs can reactivate potentially unresponsive, anergic T cells, such as those frequently encountered among TIL populations thereby enhancing the spread of T cells reactive towards other antigens (epitope spreading). Proximal contact between T cells and tumor cells could directly reactivate tumor infiltrating lymphocytes specific for cancer antigens other than directed by BRiTE, without cross-presentation. The EGFRvIII x CD3 BRiTE molecule has the potential to directly activate and expand pre-existing T cells among a polyclonal population that are specific for tumor antigens other than EGFRvIII. Indeed, others have discovered that by re-activating pre-existing T cell clones using a CD3 binding bispecific antibody specific for Wilms’ tumor protein (WT1) it is possible to induce effective and persistent epitope spreading responses to multiple antigens. If the clinical utility of this mechanism of epitope spreading is confirmed, this could provide an exciting mechanism to combat tumor heterogeneity.

6

Importantly, our data suggest that once APTN-101 reaches the brain, it can activate even suppressive Tregs to kill glioblastoma tumor cells by redirecting their natural granzyme-mediated cytotoxic potential and enhance a cytotoxic immune response. These findings not only highlight a new mechanism by which BRiTEs may circumvent certain aspects of Treg mediated suppression, but also have broader implications with regard to the natural functional role of activated, tumor infiltrating Tregs that ordinarily suppress and kill cytotoxic T lymphocytes in the tumor microenvironment.

By tethering cytotoxic effectors to target cells without the need for antigen presentation via the MHC, BRiTEs can furthermore overcome tumor immune escape mechanisms, such as the downregulation of MHC.

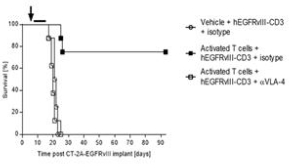

In addition to enhancing the biodistribution of EGFRvIII x CD3 BRiTE to the brain, the activated polyclonal T cells (compared to the addition of no activated polyclonal T cells or naïve polyclonal T cells) have the potential to restore effector T cells function at intracerebral sites (Figure 3) leading to cures in greater than 75% of animals.

Figure 3- IV administration of activated T cells enhances hEGFRvIII-CD3 bi-scFv efficacy against syngeneic, highly-invasive, orthotopic glioma (right panel) compared to IV administration of naïve T cells when combined with hEGFRvIII-CD3 bi-scFv (left panel). The highly invasive murine glioma CT-2A-EGFRvIII was implanted orthotopically in human CD3 transgenic mice (females, 8-10 weeks old, n=10 per group).

Next, we hypothesized that the increase in efficacy observed with the pre-administration of activated polyclonal T cells would be abrogated if those T cells were to be blocked from entering the CNS parenchyma. Natalizumab, a clinically approved drug for the treatment of multiple sclerosis, functions by binding to polyclonal T cells and preventing their association with receptors involved in the process of extravasation. Remarkably, in cohorts of mice receiving adoptive transfer of activated polyclonal T cells along with treatment with the extravasation blocking molecule natalizumab, efficacy was decreased to levels observed in cohorts that did not receive adoptive transfer of activated polyclonal T cells (Figure 4).

Figure 4- Blocking T cell extravasation with Natalizumab (αVLA-4) abrogates the observed increase in efficacy with adoptive cell transfer (n=8 per group). Natalizumab is a clinically approved drug for the treatment of multiple sclerosis that functions by blocking T cell extravasation.

We have also demonstrated an effective “antidote” for any potential toxicity that may result from administration of the EGFRvIII x CD3 BRiTE in a clinical setting. By administering a short peptide that spans the EGFRvIII mutation (PEPvIII), we have effectively blocked bispecific antibody function both in vitro and in vivo, providing a tool highly likely to aid in safe clinical administration of any EGFRvIII targeted bispecific antibody.

The above data demonstrates that BRiTE technology has the ability to transport difficult to deliver agents, including T cell targeting agents, across the BBB and demonstrate superior antineoplastic activity in aggressive orthotopic models of GBM while having an acceptable safety profile. This newly uncovered hitchhiking mechanism of drug delivery to the CNS provides an important tool to enhance the immunotherapy of brain tumors and has potentially far-reaching consequences for the treatment of other CNS disorders, such as Alzheimer’s or Parkinson’s disease, where issues regarding drug delivery to the CNS are relevant.

7

In summary, the results of preclinical studies demonstrate that the EGFRvIII targeting BRiTE may provide a safe, highly effective therapeutic option for GBM patients. Future studies will determine whether these results can be recapitulated in the clinical setting and whether BRiTEs favorably interact with other therapies that are currently employed as a standard-of-care for GBM patients.

APTN-101 Clinical Studies

The proposed Phase 1 study will evaluate a novel hEGFRvIII-CD3-biscFv Bispecific T cell engager (BRiTE) in patients diagnosed with pathologically documented supratentorial WHO grade IV malignant glioma with an EGFR mutation (either newly diagnosed or at first progression/recurrence) at the Preston Robert Tisch Brain Tumor Center at Duke University.

The primary objective of this Phase 1 study is to determine the safety and tolerability of BRiTE and recommend Phase 2 dose of BRiTE injected with and without activated polyclonal T-cells in among a patient population that includes newly diagnosed patients after completion of standard of care therapy consisting of radiation and adjuvant temozolomide, and patients at first progression (defined as progression during or after standard of care radiation and adjuvant temozolomide).

Another secondary objective is to describe the PK in subjects treated with BRiTE. A population PK analysis will be performed to characterize the PK of BRiTE using the software Nonlinear Mixed Effects Modeling (NONMEM, version 7.2). Different structural PK models (e.g., 1 and 2 compartment) with linear or non-linear (e.g., Michaelis-Menten) kinetics will be fitted to the plasma concentration-time data of BRiTE.

Exploratory objectives include an evaluation of the pharmacodynamics effect of BRiTE, an evaluation of the formation and incidence of anti-BRiTE antibodies, and a description of overall survival and progression-free survival.

Our Intellectual Property

We strive to protect the proprietary technology that we believe is important to our business, including our product candidates and our processes. We seek patent protection in the United States and internationally for our product candidates, their methods of use and processes of manufacture, and any other technology to which we have rights, as appropriate. Additionally, we have licensed the rights to intellectual property related to certain of our product candidates, including patents and patent applications that cover the products or their methods of use or processes of manufacture. The terms of the licenses are described below under the heading “License Agreement.” We also rely on trade secrets that may be important to the development of our business.

We hold a world-wide exclusive license to three issued or allowed United States patents and one pending PTC patent application covering the enhanced delivery of drugs and other compounds to the brain and other tissues. The patents and patent applications that we licensed provide patent terms or anticipated patent terms ranging from 2031 to 2039 without patent term extensions.

Our success will in part depend on the ability to obtain and maintain patent and other proprietary rights in commercially important technology, inventions and know-how related to our business, the validity and enforceability of our patents, the continued confidentiality of our trade secrets, and our ability to operate without infringing the valid and enforceable patents and proprietary rights of third parties. We also rely on continuing technological innovation and in-licensing opportunities to develop and maintain our proprietary position.

We cannot be sure that patents will be granted with respect to any of our pending patent applications or with respect to any patent applications we may own or license in the future, nor can we be sure that any of our existing patents or any patents we may own or license in the future will be useful in protecting our technology and products.

License Agreement

Patent License Agreement with Duke University

Effective January 11, 2023, Private Adaptin entered into a patent license agreement (the “Duke License”) with Duke University, a nonprofit educational and research institution organized under the laws of North Carolina (“Duke University”), whereby Duke University granted Private Adaptin an exclusive license with a right to grant sublicenses to “BISPECIFIC EGFRvIII ANTIBODY ENGAGING MOLECULES,” “HUMAN BISPECIFIC EGFRvIII ANTIBODY AND CD3 ENGAGING MOLECULES,” “CERTAIN IMPROVED HUMAN BISPECIFIC EGFRvIII ANTIBODY ENGAGING MOLECULES” and “ENHANCED DELIVERY OF DRUGS AND OTHER COMPOUNDS TO THE BRAIN AND OTHER TISSUES” (together, the “precision medicine technology”). With this technology, which the Company assumed pursuant to the Merger, we intend to develop our BRiTE Platform, a combination of an immune cell engager with activated functional T-cells, which focuses on transporting difficult to deliver agents across the blood brain barrier, allowing access to the immunoprivileged central nervous system. Under the Duke License, we are required to use commercially reasonable efforts to obtain and retain the relevant governmental approvals and to commercialize the precision medicine technology. We must also use reasonable efforts to reach certain commercialization and research and development milestones as outlined in the Duke License.

8

On August 8, 2024, Private Adaptin entered into a Sponsored Research Agreement (the “SRA”), which the Company assumed pursuant to the Merger, whereby Duke University agreed to perform research exploring the administration methods of our BRiTE Platform for a fixed fee. The Duke License has been amended (the “First Amendment”) such that the Company has the option to add any invention conceived as a result of the performance under the SRA to the license.

As part of the consideration for the license, Private Adaptin issued Duke University shares, representing 5% of its issued and outstanding common stock on a fully diluted basis. Following the Merger, Duke University holds 2.0% of the combined Company. We also agreed to make payments based on clinical and commercial milestones and continuing royalty payments on any sales made after approval by regulatory authorities. These milestones include initiation of a Phase II or Phase III clinical trials, submission of applications for market approval in multiple jurisdictions including the United States, European Union and Japan and the initiation of post-approval commercial sales in the same jurisdictions. Based on an assumption that all milestones related to the current development program are met during the course of the Duke License, these milestone payments would total approximately $11.7 million. Under the terms of the Duke License, we must pay running royalties equal to low- to mid-single digit percentages of annual net sales, depending on the level of sales by us, our sublicensees and affiliates in that year, and subject to downward adjustment to low single digit percentages of our net annual sales in the event there is no valid claim of a patent for the product, with minimum annual royalty levels established. We also must pay Duke University low to mid-double-digit percentages of any sublicensing fees as set forth in the Duke License. We will be responsible for all patent expenses incurred by Duke University and must reimburse Duke University for previous patent expenses incurred by Duke University for filing and prosecution of the patent rights.

The term of the Duke License will extend until the expiration of the last to expire patent rights, subject to early termination as set forth in the Duke License. The foregoing descriptions of the Duke License, First Amendment and SRA do not purport to be complete and are qualified in their entirety by the terms and conditions of the Duke License, First Amendment and SRA, forms of which are attached hereto as Exhibits 10.1, 10.2 and 10.3, respectively, and are incorporated herein by reference.

Manufacturing and Supply

We contract with third parties for the manufacturing of all of our product candidates, and for pre-clinical and clinical studies and intend to continue to do so in the future. We do not own or operate any manufacturing facilities and we have no plans to build any owned clinical or commercial-scale manufacturing capabilities. We believe that the use of contract manufacturing organizations (“CMOs”) eliminates the need to directly invest in manufacturing facilities, equipment and additional staff. Although we rely on contract manufacturers, our personnel and consultants have extensive manufacturing experience overseeing CMOs.

We have produced the EGFRvIII x CD3 BRiTE in a fashion suitable for clinical translational and compatible with clinical biologic manufacturing infrastructure. This has included generating and certifying a Master Cell Bank and developing a scalable expression and tag-free purification and formulation process suitable for clinical translation. On the basis of our data and development work, we have had a CMO produce clinical-grade EGFRvIII x CD3 BRiTE suitable for clinical study.

As we further develop our product candidates, we expect to consider secondary or back-up manufacturers for both active pharmaceutical ingredient and drug product manufacturing. To date, our third-party manufacturers have met the manufacturing requirements for our product candidates in a timely manner. We expect third-party manufacturers to be capable of providing sufficient quantities of our product candidates to meet anticipated full-scale commercial demand but we have not assessed these capabilities beyond the supply of clinical materials to date. We currently engage CMOs on a “fee for services” basis based on our current development plans. We plan to identify CMOs and enter into longer-term contracts or commitments if and as we move our product candidates into Phase 3 clinical trials.

We believe alternate sources of manufacturing will be available to satisfy our clinical and potential future commercial requirements; however, we cannot guarantee that identifying and establishing alternative relationships with such sources will be successful, cost-effective, or completed on a timely basis without significant delay in the development or commercialization of our product candidates. All of the vendors we use are required to conduct their operations under current Good Manufacturing Practices (“cGMP”), a regulatory standard for the manufacture of pharmaceuticals.

9

Competition

The pharmaceutical industry is highly competitive and characterized by intense and rapidly changing competition to develop new technologies and proprietary products, particularly in some of the areas of high unmet medical need that we are targeting. Our potential competitors include both major and specialty pharmaceutical and biotechnology companies worldwide, many of which have far greater resources and access to capital than we do. In particular, Affimed N.V. and NexImmune, Inc. are studying the combination of immune cell engagers with T or NK cells using a different bispecific immune cell engager, and Amgen Inc. and Genentech, Inc. (a wholly owned subsidiary of Roche Holding AG) have programs using a form of EGFRvIII x CD3 bispecific T cell engager (although neither are using them in combination with activated T cells). Our success will be based in part on our ability to identify, develop, and manage a portfolio of safe and effective product candidates that address the unmet needs of patients before our competitors.

Government Regulations

The FDA and other regulatory authorities at federal, state and local levels, as well as in foreign countries, extensively regulate, among other things, the research, development, testing, manufacture, quality control, import, export, safety, effectiveness, labeling, packaging, storage, distribution, record keeping, approval, advertising, promotion, marketing, post-approval monitoring and post-approval reporting of drugs, such as those we are developing. Along with our third-party contractors, we will be required to navigate the various preclinical, clinical, and commercial approval requirements of the governing regulatory agencies of the countries in which we wish to conduct studies or seek approval or licensure of our product candidates. The process of obtaining regulatory approvals and the subsequent compliance with appropriate federal, state, local, and foreign statutes and regulations require the expenditure of substantial time and financial resources.

FDA Regulation of Drugs

Before any of our drug product candidates may be marketed in the United States, they must be approved by the FDA. The process required by the FDA before drug product candidates may be marketed in the United States generally involves the following:

| ● | completion of preclinical laboratory tests and animal studies performed in accordance with the FDA’s current Good Laboratory Practices regulations; |

| ● | submission to the FDA of an IND, which must become effective before human clinical trials may begin and must be updated annually or when significant changes are made; |

| ● | approval by an independent institutional review board (“IRB”) or ethics committee for each clinical site before a clinical trial can begin; |

| ● | performance of adequate and well-controlled human clinical trials to establish the safety and efficacy of the proposed product candidate for its intended purpose; |

| ● | preparation of and submission to the FDA of a New Drug Application (“NDA”) after completion of all required clinical trials; |

| ● | a determination by the FDA within 60 days of its receipt of an NDA to file the application for review; |

| ● | satisfactory completion of an FDA Advisory Committee review, if required by the FDA; |

| ● | satisfactory completion of an FDA pre-approval inspection of the manufacturing facility or facilities at which the proposed product is produced to assess compliance with cGMP, and to assure that the facilities, methods, and controls are adequate to preserve the product’s continued safety, purity and potency, and of selected clinical investigational sites to assess compliance with current Good Clinical Practices; and |

| ● | FDA review and approval of the NDA to permit commercial marketing of the product for particular indications for use in the United States, which must be updated annually and when significant changes are made. |

The testing and approval processes require substantial time, effort, and financial resources and each may take several years to complete. The FDA may not grant approval on a timely basis, or at all, and we may encounter difficulties or unanticipated costs in our efforts to secure necessary governmental approvals, which could delay or preclude us from marketing our product candidates. The FDA may delay or refuse approval of an NDA if applicable regulatory criteria are not satisfied, or may require additional testing, information, and/or post-marketing testing and surveillance to monitor safety or efficacy of a product candidate.

10

If regulatory approval of a product candidate is granted, such approval may entail limitations on the indicated uses for which such product may be marketed. For example, the FDA may approve the NDA with a Risk Evaluation and Mitigation Strategy (“REMS”) plan to mitigate risks, which could include medication guides, physician communication plans, or elements to assure safe use, such as restricted distribution methods, patient registries, and other risk minimization tools. The FDA also may condition approval on, among other things, changes to proposed labeling or the development of adequate controls and specifications. Once approved, the FDA may withdraw the product approval if compliance with pre- and post-marketing regulatory standards is not maintained or if problems occur after the product reaches the marketplace. The FDA may require one or more post-market studies and surveillance to further assess and monitor the product’s safety and effectiveness after commercialization and may limit further marketing of the product based on the results of these post-marketing studies. In addition, new government requirements, including those resulting from new legislation, may be established, or the FDA’s policies may change, which could delay or prevent regulatory approval of our product candidates under development.

FDA Programs for Expedited Review and Increased Exclusivity

A sponsor may seek approval of a product candidate under Fast Track and Breakthrough Therapy programs designed to accelerate the FDA’s review and approval of new drug candidates that meet certain criteria, and/or to receive increased exclusivity under the orphan drug program. We intend to pursue these programs where our product candidates qualify.

Fast Track. A new drug candidate is eligible for Fast Track designation if it is intended to treat a serious or life-threatening condition, fill an unmet medical need, and demonstrate a significant improvement in the safety or effectiveness in the treatment of that condition.

A drug that receives Fast Track designation is eligible for the following:

| ● | more frequent meetings with FDA to discuss the drug’s development plan and ensure collection of appropriate data needed to support drug approval; |

| ● | more frequent written correspondence from FDA about the design of clinical trials; |

| ● | priority review to shorten the FDA review process for a new drug from ten months to six months; and |

| ● | rolling review, which means we can submit completed sections of its NDA for review by FDA, rather than waiting until every section of the application is completed before the entire application can be reviewed. |

Under the accelerated approval program, the FDA may approve an NDA on the basis of either a surrogate endpoint that is reasonably likely to predict clinical benefit, or on a clinical endpoint that can be measured earlier than irreversible morbidity or mortality, that is reasonably likely to predict an effect on irreversible morbidity or mortality or other clinical benefit, taking into account the severity, rarity, or prevalence of the condition and the availability or lack of alternative treatments. Fast Track designation and priority review do not change the standards for approval but may expedite the development or approval process.

Breakthrough Therapy. A new drug candidate is eligible for Breakthrough Therapy designation if it is intended to treat a serious condition and preliminary clinical evidence indicates that the drug may demonstrate substantial improvement over available therapy on one or more clinically significant endpoints.

A drug that receives Breakthrough Therapy designation is eligible for the following:

| ● | All Fast Track designation features; |

| ● | Intensive guidance from the FDA on an efficient drug development program, beginning as early as Phase 1; and |

| ● | FDA organizational commitment involving senior managers. |

Orphan Drug Designation. Under the Orphan Drug Act, the FDA may grant orphan drug designation to a drug candidate intended to treat a rare disease or condition, which is generally a disease or condition that affects fewer than 200,000 individuals in the United States, or more than 200,000 individuals in the United States and for which there is no reasonable expectation that costs of research and development of the drug for the indication can be recovered by sales of the drug in the United States. Orphan drug designation must be requested before submitting an NDA. After the FDA grants orphan drug designation, the generic identity of the therapeutic agent and its potential orphan use are disclosed publicly by the FDA. Although there may be some increased communication opportunities, orphan drug designation does not convey any advantage in or shorten the duration of the regulatory review and approval process.

11

If a drug candidate that has orphan drug designation subsequently receives the first FDA approval for the disease for which it has such designation, the product is entitled to orphan drug exclusivity, which means that the FDA may not approve any other applications, including a full NDA, to market the same drug for the same indication for seven years, except in very limited circumstances, such as if the second applicant demonstrates the clinical superiority of its product or if the FDA finds that the holder of the orphan drug exclusivity has not shown that it can assure the availability of sufficient quantities of the orphan drug to meet the needs of patients with the disease or condition for which the drug was designated. Orphan drug exclusivity does not prevent the FDA from approving a different drug for the same disease or condition, or the same drug for a different disease or condition. Among the other benefits of orphan drug designation are tax credits for certain research and a waiver of the NDA application user fee.

As in the United States, designation as an orphan drug for the treatment of a specific indication in the European Union must be made before the application for marketing authorization is made. Orphan drugs in Europe enjoy economic and marketing benefits, including up to ten years of market exclusivity for the approved indication unless another applicant can show that its product is safer, more effective or otherwise clinically superior to the orphan designated product.

The inability to obtain or failure to maintain adequate product exclusivity for our product candidates could have a material adverse effect on our business prospects, results of operations and financial condition.

Other Healthcare Laws and Compliance Requirements

Our sales, promotion, medical education, clinical research, and other activities following product approval will be subject to regulation by numerous regulatory and law enforcement authorities in the United States in addition to the FDA, including potentially the Federal Trade Commission, the Department of Justice, the Centers for Medicare and Medicaid Services (“CMS”), the U.S. Department of Health and Human Services (“DHHS”) Office of Inspector General, and other divisions of DHHS, and state and local governments.

Our business and our relationships with customers, physicians, and third-party payors are and will continue to be subject, directly and indirectly, to federal and state healthcare fraud and abuse laws and regulations. These laws also apply to the physicians and third-party payors who will play a primary role in the recommendation and prescription of our product candidates, if they become commercially available products. These laws may constrain the business or financial arrangements and relationships through which we might market, sell and distribute our products and will impact, among other things, any proposed sales, marketing and educational programs. There are also laws, regulations and requirements applicable to the award and performance of federal grants and contracts. If our operations are found to be in violation of any of such laws or any other governmental regulations that apply to them, we may be subject to penalties, including, without limitation, civil and criminal penalties, damages, fines, disgorgement, the reimbursement of overpayments, the curtailment or restructuring of our operations, exclusion from participation in federal and state healthcare programs, imprisonment, contractual damages, reputational harm, and diminished profits and earnings-any of which could adversely affect our ability to operate our business and our financial results.

Restrictions under applicable federal and state healthcare related laws and regulations include but are not limited to the following:

| ● | the federal Anti-Kickback Statute; |

| ● | the civil federal False Claims Act; |

| ● | the criminal federal False Claims Act; |

| ● | the Health Insurance Portability and Accountability Act, as amended by the Health Information Technology for Economic and Clinical Health Act of 2009, and its implementing regulations (collectively, “HIPAA”); |

| ● | the civil monetary penalties statute; |

| ● | federal transparency laws, including the federal Physician Sunshine Act (“PSA”); and |

| ● | analogous or similar state, federal, and foreign laws, regulations, and requirements. |

Efforts to ensure that our business arrangements with third parties will comply with applicable healthcare laws and regulations involve substantial costs. Because of the breadth of these laws and the narrowness of the statutory exceptions and safe harbors available, it is possible that governmental authorities will conclude that our business practices do not comply with current or future statutes, regulations, or case law interpreting applicable fraud and abuse or other healthcare laws and regulations. If our operations are found to be in violation of any of these laws or any other laws, regulations, or other requirements that may apply to us, we may be subject to significant civil, criminal and administrative penalties, damages, fines, imprisonment, restitution exclusion from government funded healthcare programs, corporate integrity agreements, deferred prosecution agreements, debarment from government contracts and grants and refusal of future orders under existing contracts, contractual damages, the curtailment or restructuring of our operations and other consequences. If any of the physicians or other healthcare providers or entities with whom we expect to do business are found not to be in compliance with applicable laws, that person or entity may be subject to criminal, civil, or administrative sanctions, including exclusions from government funded healthcare programs. Moreover, availability of any federal grant funds which we may receive or for which we may apply is subject to federal appropriations law. Such grant funding may also be withdrawn or denied due to a violation of the above laws and/or for other reasons.

12

Coverage and Reimbursement; Healthcare Reform

Sales of pharmaceutical products depend significantly on the extent to which coverage and adequate reimbursement are provided by third-party payers. Third-party payers include state and federal government health care programs, managed care providers, private health insurers, and other organizations. Although we currently believe that third-party payers will provide coverage and reimbursement for our product candidates, if approved, we cannot be certain of this. Third-party payers are increasingly challenging the price, examining the cost-effectiveness and reducing reimbursement for medical products and services. In addition, significant uncertainty exists as to the reimbursement status of newly approved healthcare products. The United States government, state legislatures, and foreign governments have continued implementing healthcare reform and cost containment programs, including price controls, restrictions on coverage and reimbursement and requirements for substitution of generic products. Adoption of price controls and cost containment measures, and adoption of more restrictive policies in jurisdictions with existing controls and measures, could further limit our net revenue and results. We might need to conduct expensive clinical studies to demonstrate the comparative cost-effectiveness of our product candidates. Third-party payers might not consider the product candidates that we develop to be cost-effective and not cover or sufficiently reimburse for their use. It is time-consuming and expensive for us to seek coverage and reimbursement from third-party payers, as each payer will make its own determination as to whether to cover a product and at what level of reimbursement. Thus, one payer’s decision to provide coverage and adequate reimbursement for a product does not assure that another payer will provide coverage or that the reimbursement levels will be adequate. Moreover, a payer’s decision to provide coverage for a drug product does not imply that an adequate reimbursement rate will be approved.

Foreign Regulation

In addition to regulations in the United States, we will be subject to a variety of foreign regulations governing clinical trials and commercial sales and distribution of our product candidates to the extent we choose to develop or sell any product candidates outside of the United States. The approval process varies from country to country and the time may be longer or shorter than that required to obtain FDA approval. The requirements governing the conduct of clinical trials, product licensing, pricing and reimbursement, and privacy, can vary greatly from country to country.

Employees

As of the Effective Time of the Merger, we had four employees, all of whom are located in the United States. None of our employees is represented by a labor union or covered by a collective bargaining agreement. We consider our relationship with our employees to be good.

Property

The Company owns no real property. We maintain a month-to-month membership providing mail services and shared space for meetings and other business activities at 3540 Toringdon Way, Suite 200, #250, Charlotte, North Carolina. The current rent is approximately $100 per month.

Litigation

From time to time, we may become involved in various lawsuits and legal proceedings that arise in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm business.

We are currently not aware of any pending legal proceedings to which we are a party or of which any of our property is the subject, nor are we aware of any such proceedings that are contemplated by any governmental authority.

Available Information

Our principal offices are located at 3540 Toringdon Way, Suite 200, #250, Charlotte, NC 28277 and our telephone number is (888) 609-1498. Our website is www.adaptinbio.com, and we can be contacted at info@adaptinbio.com. We are subject to the informational requirements of the Exchange Act and file or furnish reports and other information with the SEC. Such reports and other information filed by us with the SEC will be available free of charge on our website at www.adaptinbio.com when such reports are available on the SEC’s website. The SEC maintains a website that contains reports, information statements and other information that issuers file electronically with the SEC at www.sec.gov.

13

The contents of the websites referred to above are not incorporated into this filing. Further, our references to the URLs for these websites are intended to be inactive textual references only.

ITEM 1A. RISK FACTORS.

As a smaller reporting company as defined in Item 10 of Regulation S-K (17 CFR § 229.10(f)(1), we are not required to include risk factors in this Report.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

ITEM 1C. CYBERSECURITY.

The Company has a cybersecurity strategy designed to protect our information

systems and data from an evolving cyber-threat landscape.

Our cybersecurity program focuses on all areas of our business, including

cloud-based environments, devices used by employees and contractors, facilities, networks, applications, vendors, disaster recovery, business

continuity and controls and safeguards enabled through business processes and tools. We continuously monitor for threats and unauthorized

access. We learn of security threats through automated detection solutions as well as reports from users and business partners. We draw

on the knowledge and insight of external cybersecurity experts and vendors and employ an array of

As of the date of this Report, we have

ITEM 2. PROPERTIES.

Our principal executive offices are located in North Carolina under a month-to-month lease arrangement. We currently lease the office space that we use in our operations, and we do not own any real property. We believe that our facility space adequately meets our needs and that we will be able to obtain any additional operating space that may be required on commercially reasonable terms.

ITEM 3. LEGAL PROCEEDINGS.

We are currently not aware of any pending legal proceedings to which we are a party or of which any of our property is the subject, nor are we aware of any such proceedings that are contemplated by any governmental authority.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

14

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market Information

Our Common Stock is not listed on a national securities exchange, an over-the-counter market or any other exchange. Therefore, there is no trading market, active or otherwise, for our Common Stock and our Common Stock may never be included for trading on any stock exchange, automated quotation system or any over-the-counter market.

Holders

As of March 31, 2025, there were 141 holders of our 8,401,481 shares of our Common Stock.

Dividends

The Company has not paid any cash dividends on its shares of its Common Stock to date. The payment of cash dividends in the future will be dependent upon our revenues and earnings, if any, capital requirements and general financial condition. The payment of any dividends will be within the discretion of the Board of Directors.

Performance Graph

Not applicable.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Offerings

Except as previously reported by the Company on its Current Reports on Form 8-K, we did not sell any securities during the period covered by this Form 10-K that were not registered under the Securities Act.

ITEM 6. [RESERVED]

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

As discussed elsewhere in this Annual Report on Form 10-K for the year ended December 31, 2024 and below, on February 11, 2025, our wholly owned subsidiary, Adaptin Acquisition Co., merged with and into Private Adaptin. In connection with the Merger, Private Adaptin became a wholly owned subsidiary of the Company, and the Company changed its name to Adaptin Bio, Inc.

The following discussion and analysis is exclusively attributable to the operations of Unite Acquisition for the years ended December 31, 2024 and 2023. This discussion and analysis should be read in conjunction with our financial statements for the years ended December 31, 2024 and 2023 and the related notes thereto, which have been prepared in accordance with GAAP. The preparation of these financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of expenses during the reporting period. Actual results could differ from those estimates.

Overview of our Business

We were incorporated in the State of Delaware on March 10, 2022. From inception through the date of the Merger, the Company was engaged in organizational efforts and obtaining initial financing. The Company was formed as a vehicle to pursue a business combination and focused its efforts to identify a possible business combination.